The Marnier Lapostolle family, controlling shareholders of the Grand Marnier brand in France, can thank the cocktail-culture revival in the U.S. for the 60.4% premium that Italy’s Gruppo Campari just agreed to pay to acquire the company.

Grand Marnier Portfolio

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

In a deal valued at $759 million (€ 684 million), Campari has agreed to acquire the French listed company Société des Produits Marnier Lapostolle S.A. (‘SPML’.) Simultaneously, the Group has entered into an agreement with SPML for the exclusive worldwide distribution of the Grand Marnier spirits portfolio.

Bob Kunze-Concewitz, Gruppo Campari Chief Executive Officer, commented: ‘We are delighted to consolidate this alliance between the SPML controlling family shareholders and Gruppo Campari. Grand Marnier is a French icon, with a rich 150-year history for which we have profound respect. This acquisition represents a perfect fit with our external growth strategy in terms of brand profile, distribution and financial framework. With Grand Marnier, we add a premium and distinctive brand to our Global Priorities portfolio, thus driving richer product mix, and we further consolidate our position as the leading purveyor of premium liqueurs and bitter specialties worldwide.

In terms of route-to-market, Grand Marnier is a unique opportunity to continue leveraging our enhanced international distribution capabilities benefiting from a perfect fit of the distribution reach of the acquired business. Moreover, we continue leveraging our strong marketing capabilities and consolidated track record in re-launching and accelerating momentum of high potential brands. Thanks to its exceptional quality and international recognition, Grand Marnier enhances our exposure to the premium on-trade, across all markets, to the benefit of the Group’s overall portfolio, as well as to Global Travel Retail. In particular, as a key ingredient in many classic cocktails and a must have premium brand in classic cocktail bars, Grand Marnier strengthens our quest to further capitalize on the revival of classic cocktails, particularly in the US. Importantly, a global trend unleashed in the US with mixologists and premium consumers showing growing interest in specialties and liqueurs in the on-premise channel.

Grand Marnier will benefit from the strategic focus of the strengthened Gruppo Campari RTM as a key Brand within our Global Priorities portfolio across all markets. By acquiring Grand Marnier, we continue leveraging our acquisition framework in a very disciplined and consistent manner also from a financial view point as we consolidate a high-margin brand and cash generative business, expected to determine an immediate accretive effect on the existing business.”

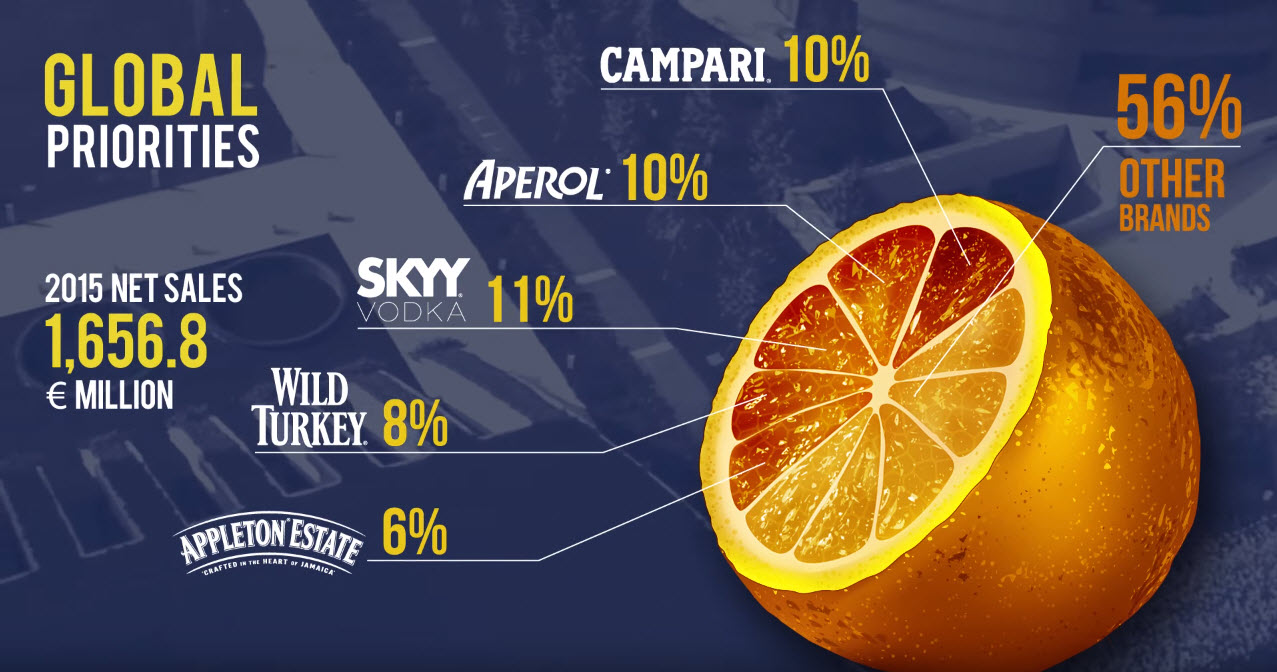

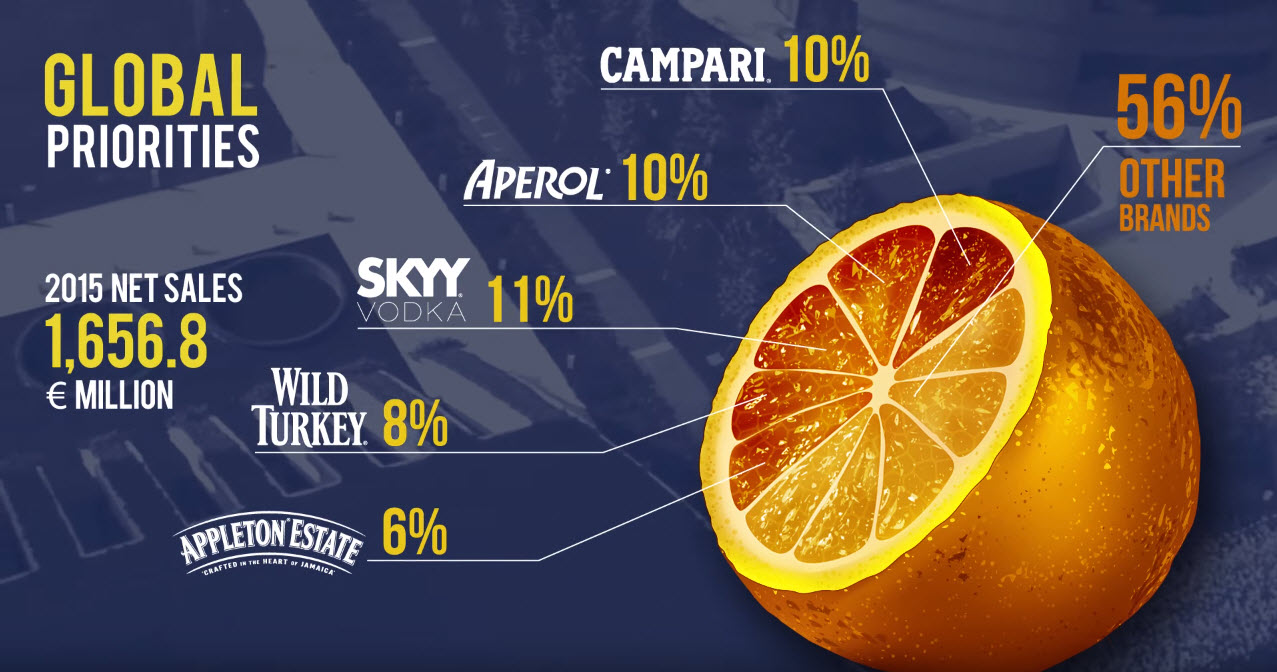

Campari Global Strategic Brands

Campari Growth Stategy

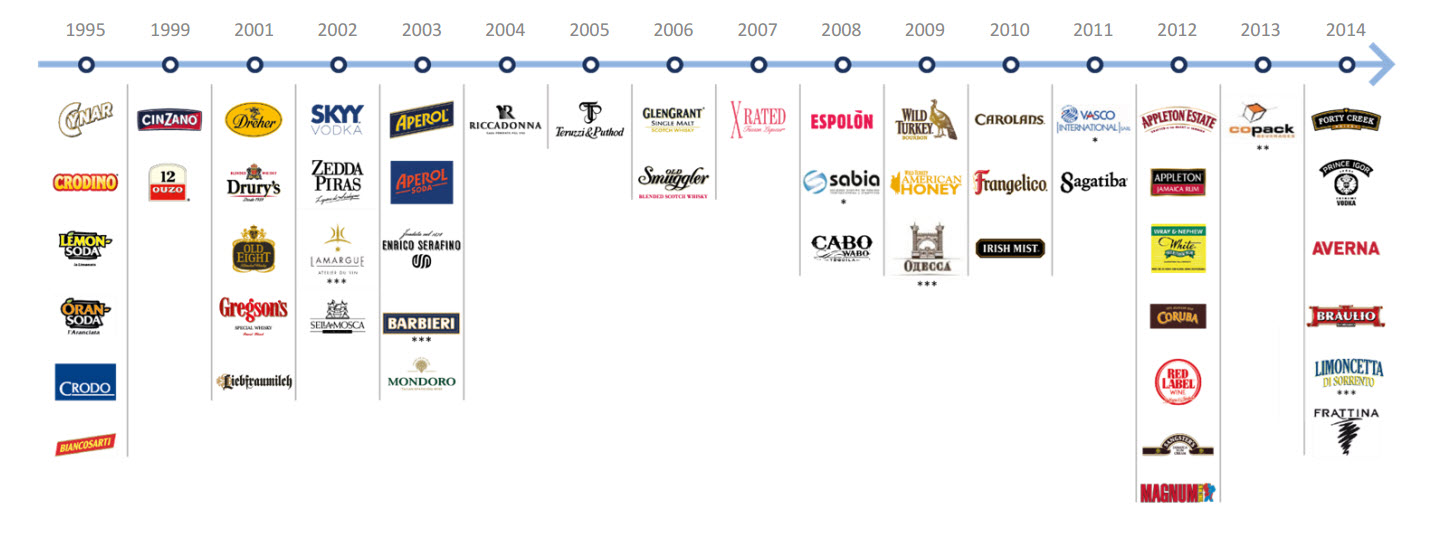

Campari’s strategy is to have 50% organic growth and 50% external growth via acquisitions. They have completed 24 acquisitions since 1995. Their three main acquisitions have been Appleton Estate Rum, Skyy Vodka and Wild Turkey Bourbon. This is their first major acquisition since 2014.

Please help to support Distillery Trail. Like us on Facebook and Follow us on Twitter.