To paraphrase another famous line, “We are from the New York Times and we are here to help.” Everyone is familiar with the sentiment of this famous line. In a similar vein, the New York Times Opinion Video below is riding the same course with, “We here at Opinion Video are not a bunch of temperance reformers coming to take away your six-packs and single malts. We just think there’s a lot more that American lawmakers could be doing to lessen the harm that alcohol causes.”

NYTimes Solution to Reduce Alcohol Consumption? Raise Taxes

The argument is, to reduce alcohol consumption, raise the price. Since brands won’t randomly raise the price on their own then the solution is to have the government raise the price by imposing a larger excise tax or in the case of alcohol, increase the sin tax. The trouble with the theory is that according to a study published in 2019 “price-based policies may have little effect in reducing consumption amongst the heaviest drinkers, provided they can switch to lower quality alternatives.” In other words,people won’t drink less, they’ll simply buy cheaper booze.

Another study out of Illinois showed the same thing that alcohol tax hikes resulted in consumers merely switching to cheaper products, not reducing their overall alcohol consumption: “We show that tax-induced increases in alcohol prices can lead to substantial substitution and avoidance behavior that limits reductions in alcohol consumption . . . consumers react by switching to less expensive products. In particular, they increase purchases of beer, thus significantly moderating any tax-induced reductions in total ethanol consumption.”

Who are the NYTimes Opinion Writers?

Before we jump into the text of what the New York Times Opinion Writers are recommending let’s take a quick look at who they are.

“Opinion Video, a small team of journalists and filmmakers founded in 2018, combines original reporting with creative storytelling to produce visually transformative commentary. We make documentary films, argued video shorts and video Guest Essays that allow voices from outside The Times to speak directly to our audiences.” Beyond this broad statement, it’s not clear who the voices are behind this temperance piece.

And here is their opinion.

How to Fix America’s Other Drug Problem; Alcohol –According to the NYTimes

The Opinion Video above is about a drug problem — but not the one you may think. While the United States struggles to deal with the opioid crisis, there’s a quieter drug epidemic that has been unfolding for a lot longer. It involves a substance that was normalized long ago but that, by some measures, plays a role in more than 140,000 deaths a year. It’s alcohol. But don’t worry. We here at Opinion Video are not a bunch of temperance reformers coming to take away your six-packs and single malts. We just think there’s a lot more that American lawmakers could be doing to lessen the harm that alcohol causes. Sure, the government has set limits on how, where, when and to whom alcohol can be sold. But there’s another highly effective measure that officials have largely ignored: tax increases. This isn’t a new idea. Yet alcohol taxes have remained stubbornly stagnant. Alcohol taxes are typically excise taxes imposed on producers and sellers, who generally pass along those costs to consumers. But excise tax rates are based on a fixed amount per volume of alcohol. So, unless lawmakers periodically increase them, the rates can quickly lose value because of inflation. As a result, researchers say, the costs of alcohol-related harm — including expenses related to health care, law enforcement and losses in workplace productivity — have dwarfed alcohol tax revenues. Philip J. Cook, a Duke University professor emeritus and an expert on alcohol policy, says the solution is higher taxes. “The goal is not prohibition, but moderation,” he writes in his book “Paying the Tab.” “Alcoholic beverages are too cheap for our own good.”

What Can You Do? Time to Push Back and Say NO.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Spirits United, a community of advocates united with a common goal to ensure adult consumers can enjoy distilled spirits where they want, how they want and when they want, responsibly, released a response to the opinion piece that is recommending people go to the NYTimes.com site and say NO.

Here are some points they have shared for your consideration.

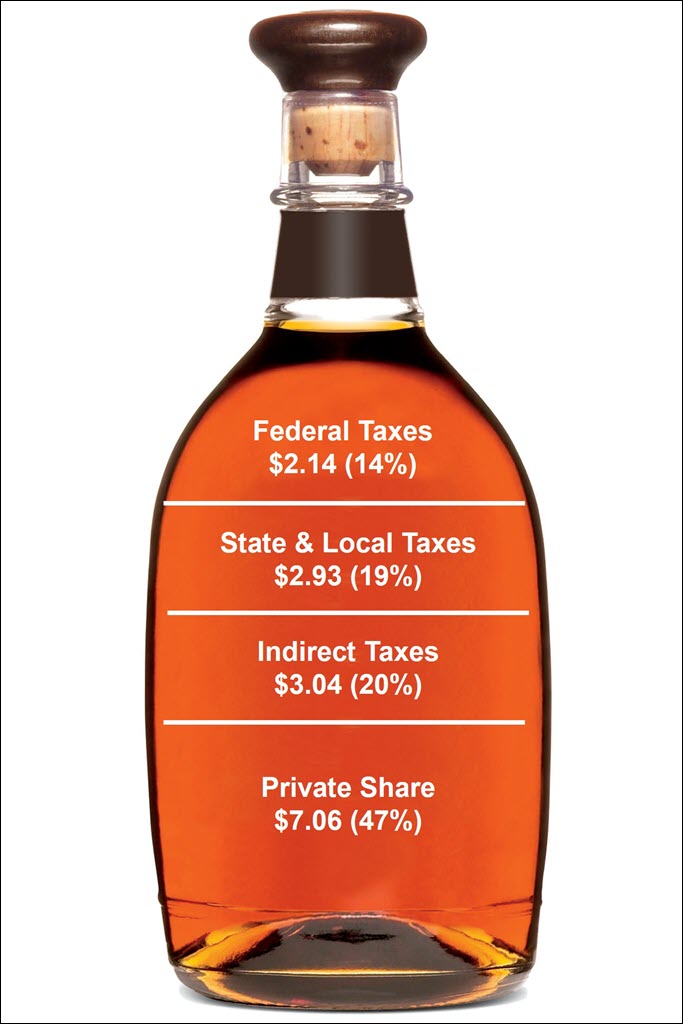

- A typical 750ml bottle of spirits costs $15.17. 53% ($8.11) of that goes to pay taxes or fees.

- Distilled spirits are already one of the highest taxed consumer products, with a whopping 53% of the price of a typical bottle of spirits going to taxes and fees.

- Consumers pocketbooks are already pinched thanks to inflation and the high cost of food and beverages.

- The NYT opinion piece relies on grossly outdated data: a study that was published in 2010 that included data from 1911!

- The prevalence of underage and binge drinking has been on decline since 2010.

- Raising taxes on the millions of American adults who drink in moderation, is neither a fair nor effective way to reduce harmful drinking. A recent Illinois study found the state’s alcohol tax hike resulted in consumers merely switching to cheaper products, not reducing overall alcohol consumption.

- Restaurants & bars are still struggling to recover from the pandemic amid rising inflation and staff shortages. Now is the worst time to hit hospitality businesses with another tax.

You can go to the NYTimes website to share your own Opinion.

Paying the Tab: The Costs and Benefits of Alcohol Control

Philip J. Cook’s book was first released in 2007.

“What drug provides Americans with the greatest pleasure and the greatest pain? The answer, hands down, is alcohol. The pain comes not only from drunk driving and lost lives but also addiction, family strife, crime, violence, poor health, and squandered human potential. Young and old, drinkers and abstainers alike, all are affected. Every American is paying for alcohol abuse. Learn more or purchase Paying the Tab: The Costs and Benefits of Alcohol Control.”

Philip J. Cook grew up on a farm outside of Buffalo, New York, the youngest of four brothers. He continued his education at the University of Michigan (class of 1968) and the University of California, Berkeley, where he experienced the challenges of studying econometrics while tear gas grenades and rocks were being lobbed outside the classroom window. His 40-year career at Duke University has provided the chance to teach and research on a variety of issues relating to public safety, health, and social policy.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.