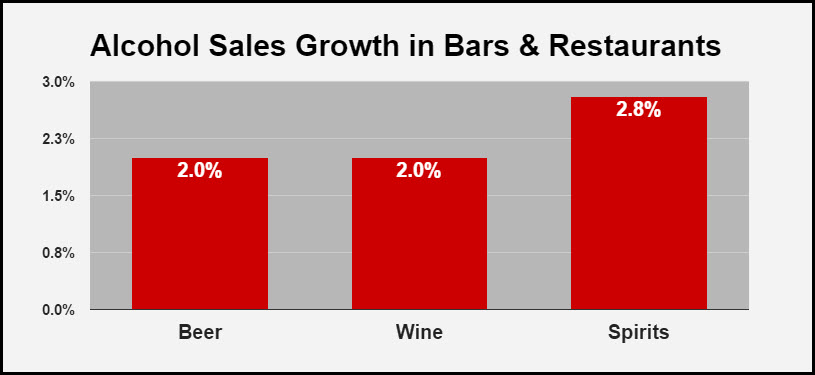

Spending on spirits is expected to grow at a rate of 2.8%, the fastest expansion of all alcohol categories due to the popularity of whiskey and craft cocktails and the ongoing premiumization trend.

In evaluating its forecasted growth expectations for beverage alcohol sales at the nation’s bars and restaurants, Technomic continues to see only modest improvements in 2016. This comes from research conducted for Technomic’s Adult Beverage Planning Program research on key topics and trends related to the adult beverage on-premise industry.

While the overall restaurant industry has been experiencing stronger momentum, slower traffic at major casual dining chains and an evolving consumer dynamic are resulting in a “new normal” in which consumer drink purchase patterns have changed. For 2016, Technomic expects overall consumer spending on beverage alcohol in the away-from-home channel to grow at a modest 2.3%, with similar expectations for 2017. Total alcohol volume in bars and restaurants is expected to be flat in 2016.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

2016 Growth Expectation by Alcohol Category

[table “” not found /]2016 Growth Expectation by On-Premise Segment

[table “” not found /]In looking at specific categories of adult beverage in on-premise locations, Henkes notes that beer remains the underachiever, with expected consumer spending growth of 2.0%. “Craft and imports are trending positively, but domestic beer – which still accounts for over half of on-premise beer volume, remains challenged.” Spending on spirits is expected to grow at a rate of 2.8%, the fastest expansion of all categories due to the popularity of whiskey and craft cocktails and the ongoing premiumization trend. Spending on wine is forecasted to grow at 2.0%.

Henkes cautions that restaurant and bar operators must ensure that the value proposition of their beverage program is aligned with their consumers’ expectations. “We continue to stress to our clients the importance of a strong adult beverage program – it drives customer satisfaction, and is obviously a source of incremental profitability” he notes. “But with consumers still cautious on spending, it’s important to stress the quality and creativity of a beverage program.”

Please help to support Distillery Trail. Like us on Facebook and follow us on Twitter.