When it comes to the price of pleasure, it comes at a cost. And in the case of spirits, smokes, gambling and marijuana that cost is much higher in the way of government imposed taxes, generally referred to as ‘sin taxes’.

What is a Sin Tax?

A sin tax is an excise tax on specific goods and services due to their ability, or perception, to be harmful or costly to society. The tax comes at the time of purchase. Some items that often have a sin tax include tobacco products, alcohol, and gambling.

Spirits, Wine, and Beer Taxes

The NYTimes recently published an opinion piece recommending that governments increase taxes on alcohol. You can read that full story here – New York Times Opinion Piece Recommends Increasing Taxes on Alcohol to Temper[ance] Consumption. While doing some research for that story we came across this spiffy ‘Sin Taxes – The Price of Pleasure’ infographic. The infographic is a bit dated but the core concept has not changed so we thought it was worth sharing. Scroll down to see the full infographic.

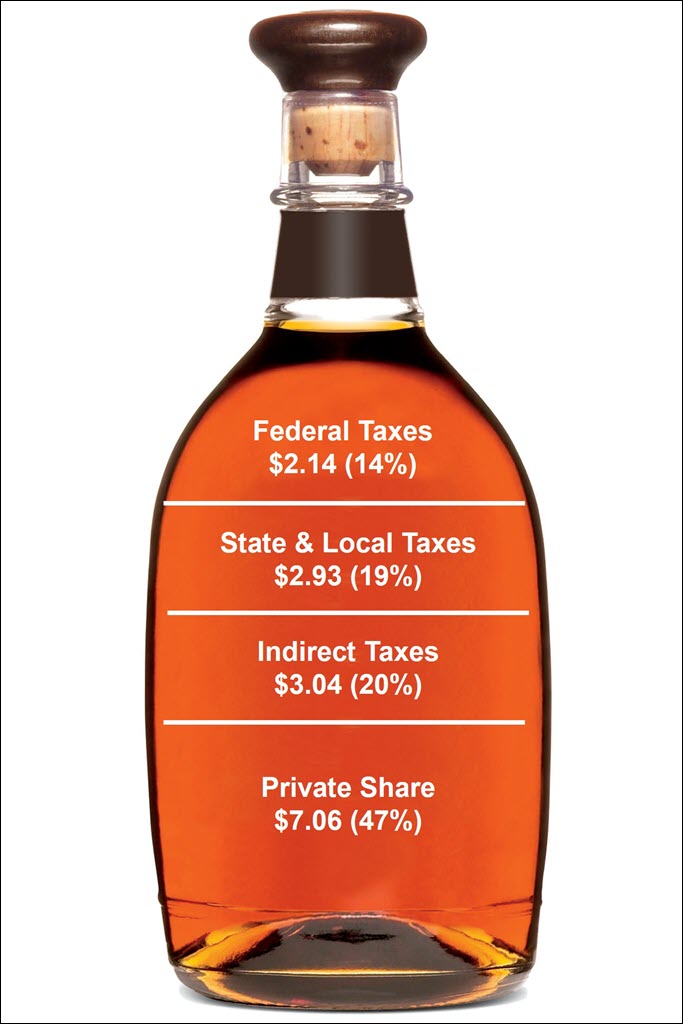

And before you look at the full infographic, here is a current graphic provided by Spirits United that shows current tax rates for a bottle of spirits.

Spirits United, a community of advocates united with a common goal to ensure adult consumers can enjoy distilled spirits where they want, how they want and when they want, responsibly, released a response to the opinion piece that is recommending people go to the NYTimes.com site and say NO.

Here are some points they have shared for your consideration.

- A typical 750ml bottle of spirits costs $15.17. 53% ($8.11) of that goes to pay taxes or fees.

- Distilled spirits are already one of the highest taxed consumer products, with a whopping 53% of the price of a typical bottle of spirits going to taxes and fees.

- Consumers pocketbooks are already pinched thanks to inflation and the high cost of food and beverages.

- The NYT opinion piece relies on grossly outdated data: a study that was published in 2010 that included data from 1911!

- The prevalence of underage and binge drinking has been on decline since 2010.

- Raising taxes on the millions of American adults who drink in moderation, is neither a fair nor effective way to reduce harmful drinking. A recent Illinois study found the state’s alcohol tax hike resulted in consumers merely switching to cheaper products, not reducing overall alcohol consumption.

- Restaurants & bars are still struggling to recover from the pandemic amid rising inflation and staff shortages. Now is the worst time to hit hospitality businesses with another tax.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

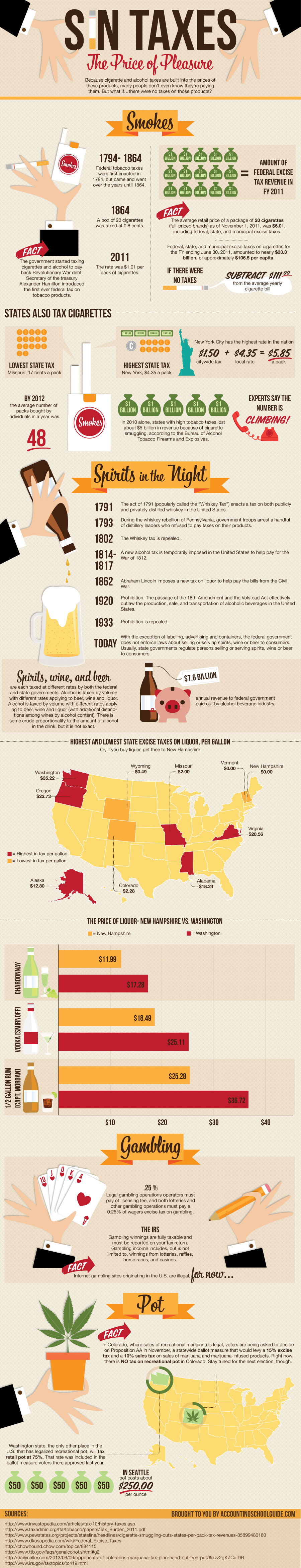

All is not equal when it comes to alcohol taxes. Spirits, wine, and beer taxes are each taxed at different rates by both the federal and state governments. Alcohol is taxed by volume with different rates applying to beer, wine and liquor. Alcohol is taxed by volume with different rates applying to beer, wine and liquor (with additional distinctions among wines by alcohol content). There is some crude proportionality to the amount of alcohol in the drink, but it is not exact.

A Brief History: Spirits in the Night

1791: The act of 1791 (popularly called the “Whiskey Tax”) enacts a tax on both publicly and privately distilled whiskey in the United States.

1793: During the whiskey rebellion of Pennsylvania, government troops arrest a handful of distillery leaders who refused to pay taxes on their products.

1802: The Whiskey tax is repealed.

1814-1817: A new alcohol tax is temporarily imposed in the united States to help pay for the War of 1812.

1862: Abraham Lincoln imposes a new tax on liquor to help pay the bills from the Civil War.

1920: Prohibition. The passage of the 18th Amendment and the Volstead Act effectively outlaw the production, sale, and transportation of alcoholic beverages in the United States.

1933: Prohibition is repealed

Today: With the exception of labeling, advertising and containers, the federal government does not enforce laws about selling or serving spirits, wine or beer to consumers. Usually, State governments regulate persons selling or serving spirits, wine or beer to consumers.

In 2019, excise tax revenue from alcoholic beverages amounted to $10.0 billion, 10 percent of total excise receipts. There are different tax rates for distilled spirits, wine, and beer.

The tax rates also vary widely by state. Here are the top 10 highest and lowest alcohol tax per gallon rates by state with 2023 data.

Highest Tax/Gallon

- Washington – $33.22

- Oregon – $21.95

- Virginia – $19.89

- Alabama – $19.11

- Utah – $15.92

- North Carolina – $14.58

- Kansas – $13.03

- Alaska – $12.80

- Maryland – $11.96

- Michigan – $11.95

Lowest Tax/Gallon

- Missouri – $2.00

- Colorado – $2.28

- Texas – $2.40

- Kentucky – $2.50

- Iowa – $2.68

- Arizona – $3.00

- Maine – $3.03

- Wisconsin – $3.25

- California – $3.30

- Nevada – $3.60

Related Story

New York Times Opinion Piece Recommends Increasing Taxes on Alcohol to Temper[ance] Consumption

Sources

- What is a Sin Tax – Investopedia

- Infographic – Accounting School Guide

- A Brief History of Taxes in the US

- Federation of Tax Administrators

- Cigarette Taxes and Cigarette Smuggling by State

- Alcohol and Tobacco Tax and Trade Bureau

- Opponents of Colorado’s marijuana tax plan hand out free pot

- IRS: Topic No. 419, Gambling Income and Losses

- Tax Policy Center

- 2023 Alcohol Tax Rate by State

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.