Everyone loves a good urban legend. One of my favorites is Bloody Mary – the ghost in the mirror, not the drink. Even when it comes to alcohol there are a few urban legends that have stood the test of time. “Beer before liquor, never sicker; liquor before beer, you’re in the clear!” Or, the wonderfully strange “trip” with the green fairy that accompanies a night of absinthe (I’ll admit I was hoping this one was true.)

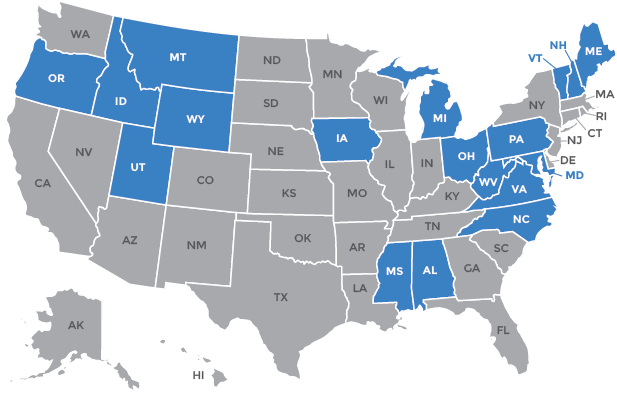

As enjoyable as these tall tales can be, they often instill in us an unnecessary fear. So let’s face that fear by debunking the urban legends surrounding one of the most misunderstood areas of the alcohol space – Control States. In this article, we’ll breakdown three of the biggest urban legends surrounding control states in the hopes of revealing the real opportunities for growth these markets can provide to those brands looking to expand outside of their home market.

Urban Legend #1: Control States are difficult to enter.

In control states there are two roads to market: Special Liquor Order (SLO) and a Listing. SLO allows suppliers to ship orders into the state on an order-by-order basis. Being listed means that the state’s ABC (Alcoholic Beverage Control) board has approved your product for sale on the shelves of the state’s liquor stores.

American Spirits Exchange is a national distributor and importer serving the alcoholic beverage industry including distilled spirits, wine and beer. Learn More Here…

Every urban legend originates out of some sliver of truth. In this instance, the view that control states are difficult to enter is centered around the latter of the two paths to market – the listing process. This process does vary slightly from state to state but they all require some combination of these basic ingredients.

- A Standard Price Quotation Form

- A presentation to the ABC board

- An in-state broker

- And a Control State Code (CSC)

These requirements aren’t all that much different than what is required to get into the market in an open state. In an open state, the presentation would be replaced with meetings with distributorships. The distributor’s sales team is the open state equivalent to the in-state broker for a control state. The main culprit that causes people to believe that control states are difficult to enter are the timeframes to submit for approval. Some control states allow for monthly opportunities to submit for a listing, but the majority only hold open listing periods between two to four times a year.

So then why say that it’s a myth that control states are difficult to enter? Because of the former path to market – the SLO. Registering for SLO is the fastest way to clear to sell in the control states. SLO has an expedited registration process similar to the open states. Once approved for sale, the benefits of SLO are:

1. It allows for any individual or account to order your product in the state

2. It provides quick access for your product to participate in special events

3. Customers that have previously visited your distillery now have the ability to go to their local store and order your product once back in their home state, and

4. Most importantly, SLO sales within the state give you a better advantage once you eventually decide to go for a listing as it shows a pre-existing demand for the product.

SLO sales are by no means a long-term sales model in control states. Consider it more like a market entry program. But it’s a market entry program that you are in control of – you determine your price (within the state’s pricing mark-up system of course), you determine the minimum order quantity you are willing to ship, and you can focus on the markets that are most likely to maximize your sales in the state.

Through SLO, control states provide suppliers with a quick path to sales one case at a time.

Urban Legend #2: Control States offer less exposure.

While all control states have complete oversight over wholesale operations, handling of retail sales outlets can vary. Some control states maintain complete oversight of retail through state-run stores, while others allow contract-operated or privately held stores. Some even give oversight of retail operations to municipalities or individual counties.

But when it comes to control states as a whole, in comparison with open states, they do have fewer retail outlets per capita. From that sliver of truth, those in the alcohol space are often under the impression that open states are more advantageous for growth. However, the truth is that control states can provide far more exposure for new brands than is realized.

Control states offer more retail stores in smaller or more remote geographic locations. In open states, these locations would not make sense for privately owned retailers. Also because control states have fewer stores then their open state counterparts, your product is often exposed to more customers on average per visit.

The control states also publish their product lists. These product books are usually available in store or on-line at the ABC’s website. This makes it easier for customers to find and purchase your product. In an open state, a customer may need to spend their time hunting online for a store that carries what they are looking for or to bargain hunt for the best price. With a control state, you have one stop shopping. The pricing is already set statewide and the ABC’s website can provide you with the locations of where product is sold. Plus with the option of SLO, they can get your product even if it is not on the shelf at their local liquor store.

More eyes on your product and easier searchability give your product a much better chance for exposure.

Urban Legend #3: Control States favor the big suppliers,

smaller suppliers have no chance to compete.

What chance does a small fish have against a big fish in a small pond? Just like in the open states, the top 10 selling distilled spirits brands in the control states are the big names we all know. And, as previously discussed with urban legend #2, control states feature fewer retail sales outlets than open states. As a result, suppliers often feel they have less of an opportunity to compete against the large multi-national brands in control states. The reality is quite the opposite.

When it comes to getting a listing in a control state, the small suppliers are treated equally to the giant multi-national brands. Both are subject to the same pricing structures, same mark-ups by the state, and same placements in the stores. In control states, the ABC boards select products based on the needs of their residents. By comparison, being picked up for sale in an open state is in the hands of privately owned distributors. The large, multi-national brands will always have the advantage here as they offer larger sales margins and incentives.

Also since most suppliers are apprehensive about entering control states, there are fewer brands trying to enter the market. It provides the brands that do go for a listing a far greater chance of approval. According to the most recently available data, brands that submit for listing in control states are approved 67% of the time. This is the median average over all 17 control states. Out of the 17, four of those states had a 100% approval rate. How many distributorships in the open states can offer a brand a 67% chance of being picked up let alone a 100% chance?

The control state is not the boogeyman it’s made out to be. At first glance, entry into a control state seems daunting. In the long run, however, it can be a profitable collaboration.

Now go out there and debunk this urban legend yourself. Me, I’m going to try my hand at the finding the green fairy again.

American Spirits Exchange is a national distributor and importer serving the alcoholic beverage industry including distilled spirits, wine and beer. Learn More Here…

If you would like more information about working with American Spirits Exchange Limited please contact Chelsea Washburn at 215-240-6020 or email at Grow@AmericanSpiritsLtd.com or visit the American Spirits Exchange Ltd. website here.

Ready to Get Started?

Let American Spirits Exchange Ltd. Experts Help Grow Your Distilled Spirits Business

Our mission as a national spirits importer and distributor is to help make artisan brands broadly available, promote exceptional beverages in the U.S. and educate consumers about the art and science of craft alcohol beverages.

Call: 215-240-6020

General Information | Grow@AmericanSpiritsLtd.com

Accounting | Accounting@AmericanSpiritsLtd.com

Purchase Order Submissions | PO@AmericanSpiritsLtd.com

International Sales & Export | International@AmericanSpiritsLtd.com

Shipping, Freight Forwarding & Logistics | Shipping@AmericanSpiritsLtd.com

What is BrandScape? BrandScape is a way for product and service suppliers to talk directly to our audience. If you would like to learn more about BrandScape, please email Info@DistilleryTrail.com.