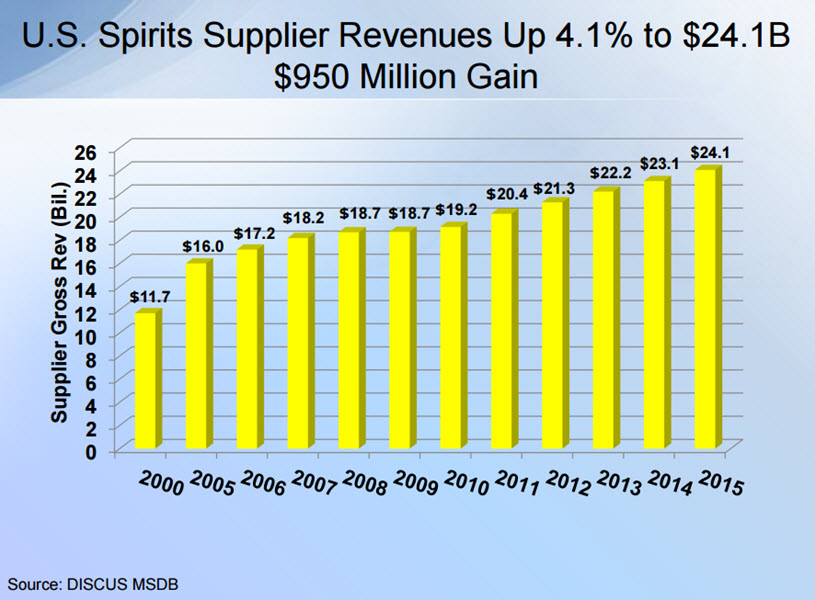

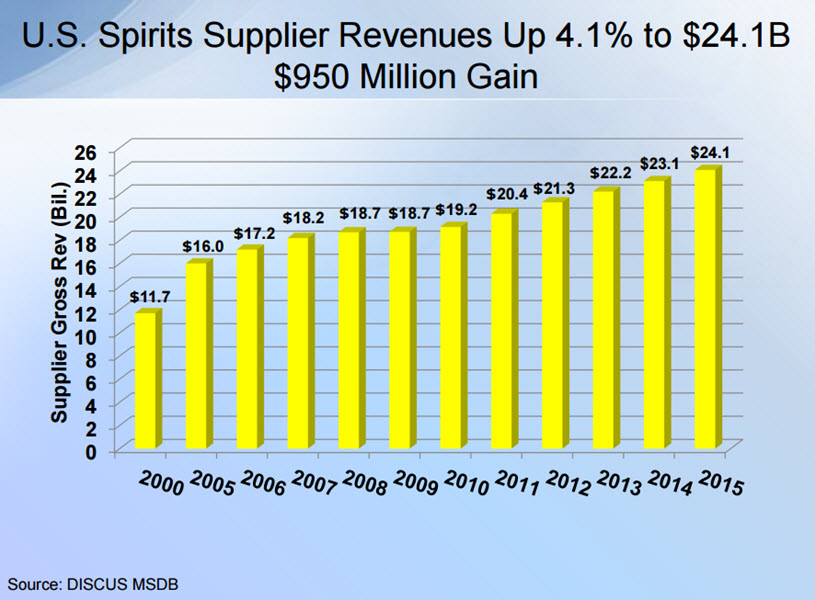

The Distilled Spirits Council of the United States – DISCUS announced another year of steady growth in 2015 with supplier sales up 4.1 percent, volumes up 2.3 percent and its sixth consecutive year of market share gain.

“The positive performance of distilled spirits is the result of many factors including market modernization, product innovation, consumer premiumization and hospitality tax restraint.”

~ Distilled Spirits Council President and CEO Kraig R. Naasz

The Council reported strong growth in every whiskey category for the second straight year, with revenues rising 8 percent. Super premium whiskeys were particularly popular among American consumers with luxury Bourbon, Scotch, Canadian and Irish whiskeys all recording double-digit gains. Other categories performing ahead of the distilled spirits average growth included Tequila, with another exceptional year of 9.4 percent sales growth, and Cognac, with sales growth of 16.2 percent.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

U.S. Spirits Supplier Revenues Up 106% Since 2000

Category Highlights for 2015

The Council estimated that overall retail sales of distilled spirits in the U.S. market reached nearly $72 billion in 2015, supporting 1.4 million jobs in the hospitality industry.

Additionally, the spirits sector achieved a slight increase in market share relative to beer for the sixth straight year in 2015. Total market share gains by spirits compared to beer since 2000 totaled 6.7 points, with each point of market share equaling approximately $680 million in supplier sales for a total of $4.6 billion.

Several key factors contributed to the spirits sector’s continued growth, including:

- Demand for American whiskeys – Bourbon, Tennessee and Rye – booming in the U.S. and abroad;

- Millennials of legal drinking age interest in discovery driving innovation and premiumization;

- State legislatures showed hospitality tax restraint protecting jobs, consumers;

- Modernized alcohol laws expanding consumer access and choice;

- Focus on craft-style, artisanal products benefiting both large and small producers;

- Consumer fascination with provenance dovetailing with spirits’ authentic heritage;

- Growth of micro-distilleries generating excitement in the spirits sector; and

- Cocktail culture continuing to define nightlife in cities across the country.

American Whiskey Boom Boosts U.S. Farmers

The appeal of American whiskey – Bourbon, Tennessee and Rye – with consumers here and abroad resulted in 7.8 percent overall growth for the category, benefiting America’s farmers and boosting exports.

According to the U.S. Department of Treasury’s Tax and Trade Bureau from 2010 to 2014

- Corn used in spirits production increased 176 percent

- Rye used in spirits production was up 64 percent

“Against the backdrop of an otherwise sluggish farm economy, it’s positive to note that American whiskey sales are benefiting America’s farmers and the agricultural sector,” said Naasz.

Overall spirits export volumes increased 3.4 percent in 2015, while American whiskey export volumes of Bourbon, Tennessee and Rye grew 4 percent due to growing consumer interest in these products around the globe.

Additional Top Performers in 2015

Both Irish Whiskey and Single Malt Scotch continued their rapid growth with revenues up 19.9 percent and 13.5 percent, worth $664 and $732 million, respectively, as reported by Distilled Spirits Council Chief Economist David Ozgo.

Cognac sales were also up an impressive 16.2 percent, generating $1.3 billion in revenue, and Tequila revenues grew 9.4 percent, generating $2.3 billion revenue. Despite growing only 0.5 percent, Vodka sales reached $5.8 billion.

DISCUS Voting Members Include

- Agave Loco Brands

- Bacardi U.S.A., Inc.

- Beam Suntory

- Brown-Forman Corporation

- Campari America

- Constellation Brands, Inc.

- Diageo

- Edrington

- Luxco, Inc.

- Moet Hennessy USA

- MGP

- Patrón Spirits Company

- Pernod Ricard USA

- Remy Cointreau USA, Inc

- Sidney Frank Importing Co., Inc.

Please help to support Distillery Trail. Like us on Facebook and Follow us on Twitter. Thank you!