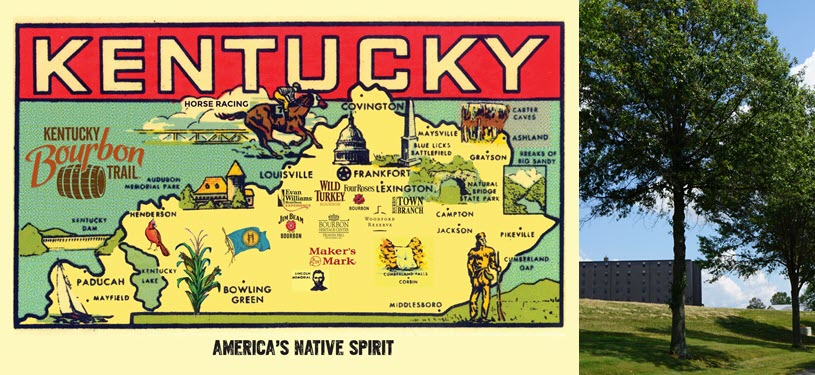

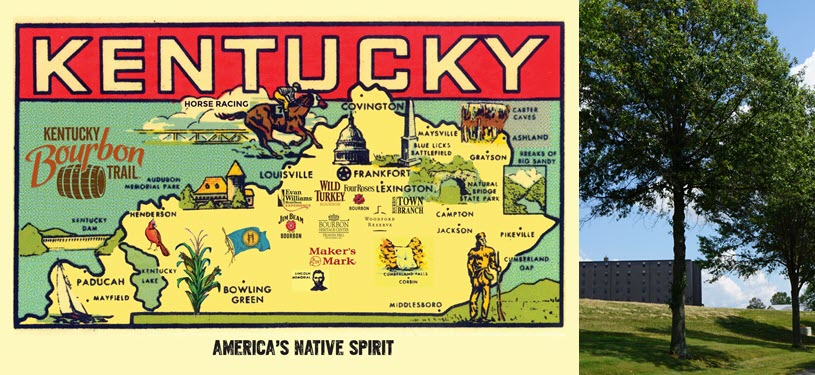

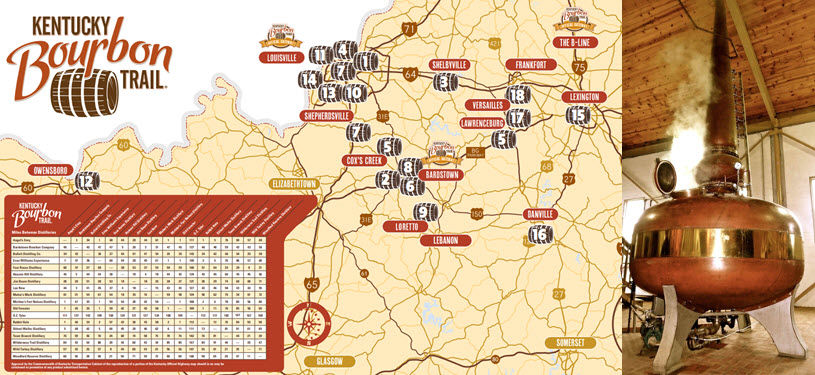

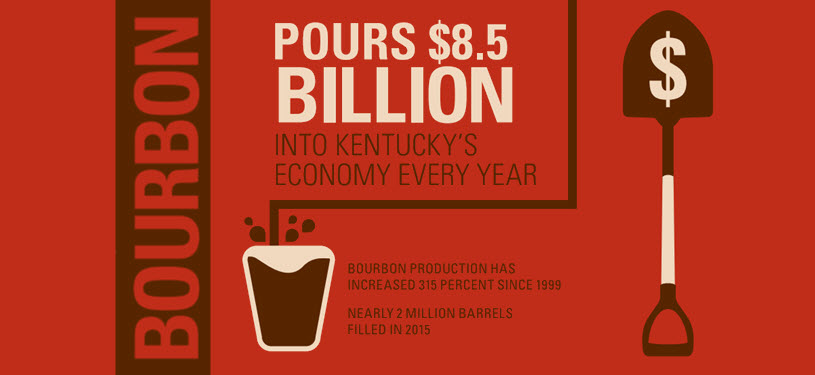

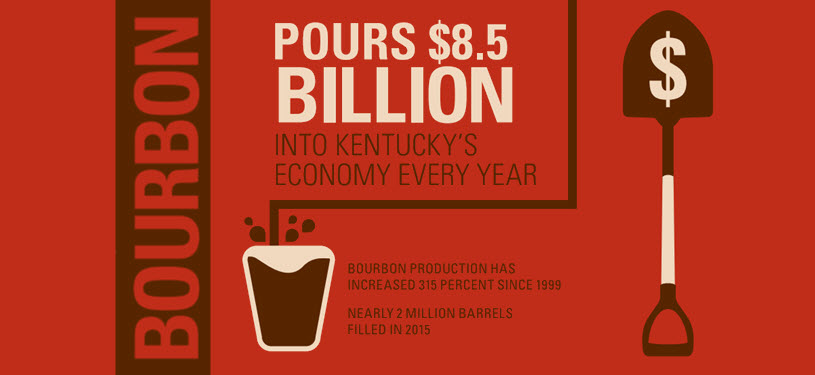

Bourbon is a signature industry that fuels economic development and tourism in the state of Kentucky. As one of the state’s top global exports, this legendary $9 billion industry sustains more than 23,100 jobs for Kentuckians with more than $1.63 billion in annual payroll. Kentucky distillers are in the middle of a 10-year, $5.4 billion building boom to expand production and create memorable Kentucky Bourbon Trail® tourism experiences for millions of guests from around the world.

For more than a decade, the Kentucky Distillers’ Association – KDA has led the way in working with members of the General Assembly to grow and enhance the states signature distilling industry with the goal of keeping Kentucky the one, true, authentic home of America’s only native spirit.

The KDA is committed to maintaining Bourbon’s role as a signature industry in Kentucky. To ensure Kentucky maintains its distilling dominance, KDA worked closely with the General Assembly to modernize archaic Prohibition-era laws.

From adding privileges essential to distilleries building world-class tourism experiences, to sunsetting repressive taxes, supporting workforce training, and promoting responsibility measures, the KDA and the General Assembly have made great strides for Kentucky.

The KDA plans on continuing to work together to create policies and quickly respond to consumer demands in the new, global marketplace and economy.

Below is a detailed timeline of some of the key steps Kentucky’s General Assembly has taken to modernize, grow and protect the states signature Bourbon industry over the last 10 years.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Bourbon — It's More Than a Drink.

-

Save

Kentucky Bourbon’s $9 Billion Economic Impact

-

Save

-

Save

Watch the Entire ‘Bourbon Economic Impact Report’ Presentation

-

Save

-

Save

Record $6.7 Billion Barrel Valuation

-

Save

-

Save

House Bill 5: Barrel Tax Phase-Out

-

Save

-

Save

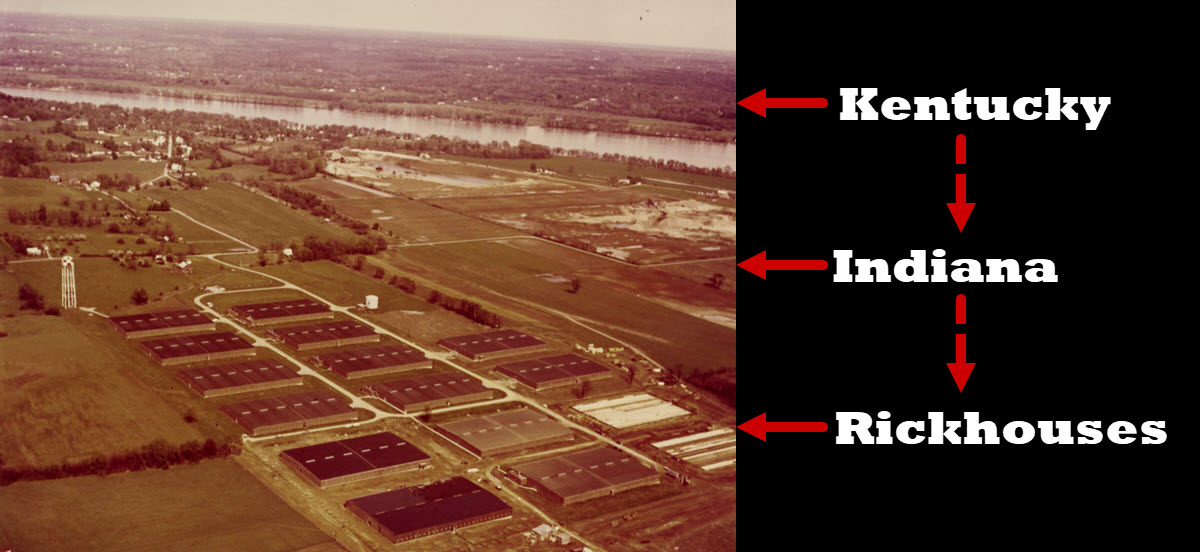

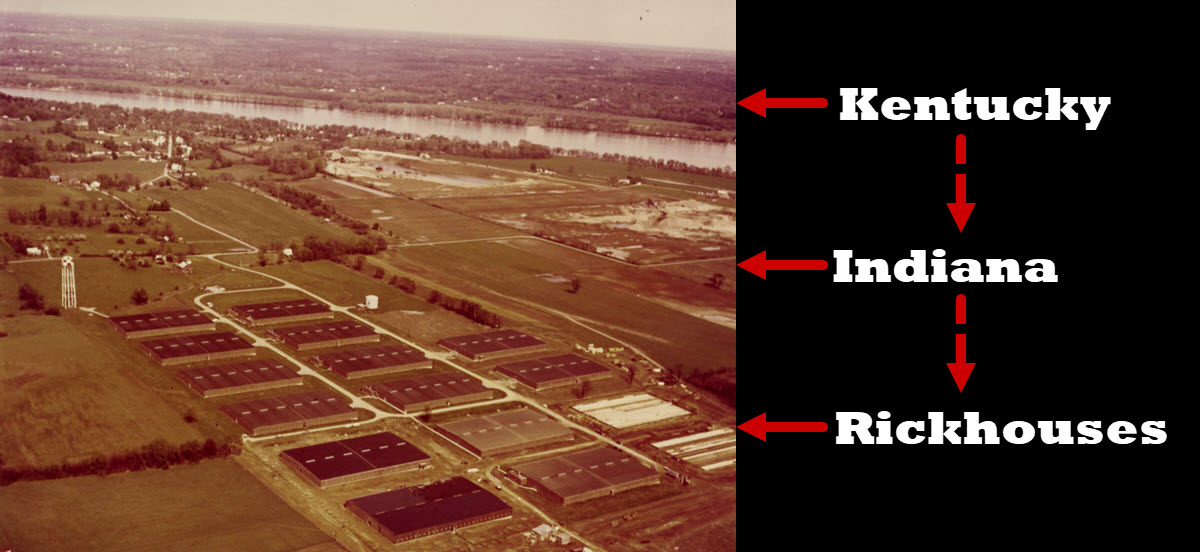

Bourbon Maker's Moved Barrels Out of State in the 60s

-

Save

-

Save

Kentucky Bourbon Trail Visitors Exceed 2+ Million Visitors

-

Save

-

Save

House Bill 500: Private Barrel Selections, Exclusive Bottles, Satellite Tasting Rooms and Fair & Festival Sales

-

Save

-

Save

Kentucky Bourbon Trail Attendance Rebounds

-

Save

-

Save

House Bill 415: Direct-to-Consumer Shipping

-

Save

-

Save

What is the Napa-fication of Kentucky?

-

Save

-

Save

Senate Bill 67: Take-Home Cocktails for Restaurants

-

Save

-

Save

Senate Bill 68: Strengthening Distillers’ Workforce Development

-

Save

-

Save

Senate Bill 5: Business Legal Liability Relief

-

Save

-

Save

House Bill 415: Direct to Consumer – DTC Shipping

-

Save

-

Save

House Bill 351: Tax Exemption Fix for Purchasing New Distilling Equipment & Fully Funding the Ignition Interlock Program

-

Save

-

Save

Senate Bill 99: More Regulatory Reforms

-

Save

-

Save

Senate Bill 150: COVID Assistance

-

Save

-

Save

Senate Bill 85: Ignition Interlocks Reform

-

Save

-

Save

House Bill 400: Distillery Visitor Center Shipping

-

Save

-

Save

House Bill 100: Vintage & Antique Spirits, Kentucky Whiskey Protections

-

Save

-

Save

Craft Beverage Modernization & Tax Reform

-

Save

-

Save

Senate Bill 11: Bourbon Tourism Reforms

-

Save

-

Save

House Bill 445: Bourbon Barrel Tax Credit

-

Save

-

Save

Senate Bill 83: Modernizing Alcohol Laws and License Types

-

Save

-

Save

House Bill 475: Alcohol in State Parks

-

Save

-

Save

Senate Bill 13: Election Day Sales

-

Save

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Learn more about the Kentucky Distillers’ Association.

View all Kentucky Distilleries.

View all U.S. Distilleries.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.