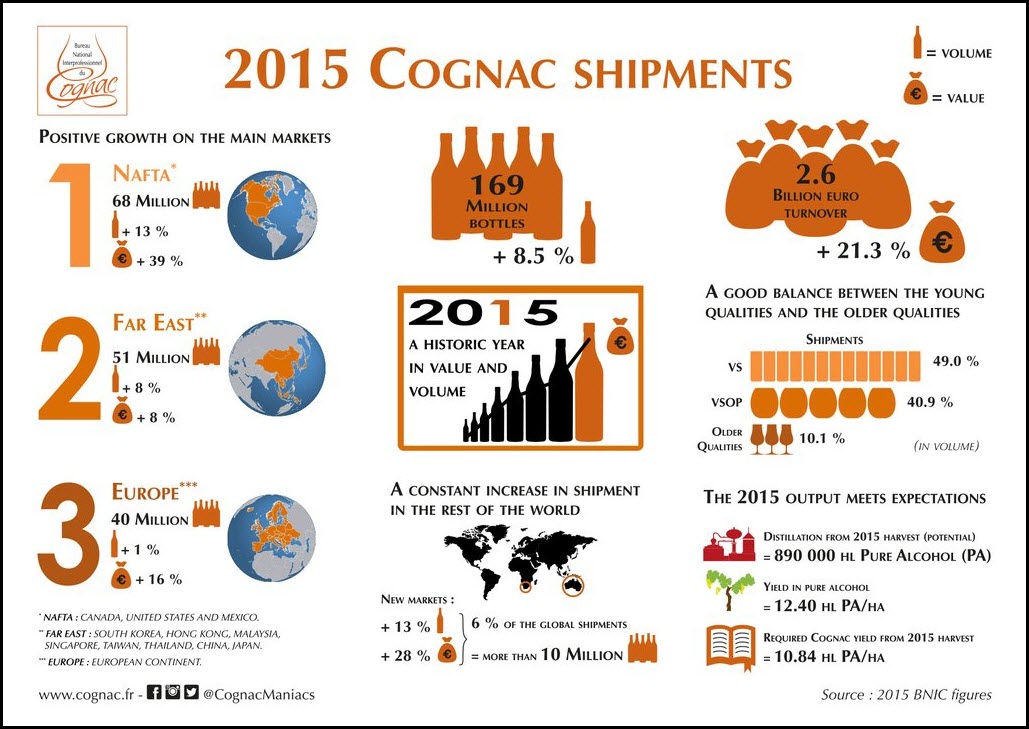

The Cognac Board (BNIC) has announced record growth in 2015, with exports reaching historical highs, both in terms of volume and value. The Cognac industry accounts for 20% of French wine and spirits exports, pulling its weight in the balance of French trade. This expansion was carried by an exceptional performance in each of Cognac’s major markets, especially in North America, where industry and consumer demand continues to increase.

After a strong 2014, Cognac’s growth continued in 2015 with exports increasing of 8.5% in volume and 21.3% in value, for a total export of more than 168.9 million bottles and a turnover of 2.6 billion euros.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Exports Continue to Rise in Major Export Zones

- With a growth of 13% in volume and 39.2 % in value, North American Free Trade Agreement (NAFTA) continues to progress, confirming its leadership in terms of volume, with 67.7 million bottles shipped in 2015, and maintaining its first place in terms of value. This excellent performance largely resulted from a continued rise of exports to the United States, which reached their highest historic level in 2015 (65.3 million bottles).

- After a year of mixed results in 2014, the Far East Southeast Asia (South Korea, Hong Kong, Malaysia, Singapore, Taiwan, Thailand), China and Japan renewed its growth with a rebound of 8.4% in both volume and value, for a total of more than 50.6 million bottles shipped to the zone during 2015. The large increase of VSOP (Very Special Old Pale) exports to China (70% of the shipments made are to China) greatly contributed to these results.

- Exports to Europe including Eastern Europe and Baltic countries (Albania, Bosnia and Herzegovina, Bulgaria, Belarus, Croatia, Estonia, Georgia, Hungary, Latvia, Lithuania, Macedonia, Moldova, Montenegro, Poland, Czech Republic, Romania, Russia, Serbia, Slovakia, Ukraine) confirmed the overall trend with stabilization in terms volume (+0.6%), for a total of more than 39.8 million bottles, and a sharp rise in value (+15.9%).

Growth Throughout the Rest of the World

The increase of exports to new markets in Africa (South Africa) and Oceania (Australia) was once again confirmed, both in terms of volume (+13.4%) and value (+27.6%). Together, these new zones now account for more than 6% of global exports in volume, for a total of more than 10 million bottles.

Balanced Demand Across Categories

Still carried by the American dynamism, the VS (Very Special) category continued its progress in both volume (+8.0%) and value (+27.8%), accounting for almost half of Cognac exports. Representing a little over 40% of exported volume, the VSOP category also showed a significant upturn with +13.1% in volume and +28.2% in value.

This increase of exports for both the VS and VSOP categories positively offset the decrease in exports of the aged categories in volume (-4.7%), a category which nonetheless enjoyed a growth +8.1% in value.

2015 Production Aligned with Increased Demand

With a yield in volume higher than 2014 (approximately 126hl Vol/ha instead of 112hl Vol/ha), for a yield in pure alcohol of 12.40 hl PA/ha, the distillation of the 2015 harvest should reach a level of approximately 890,000hl PA. The regulated annual yield for Cognac for the harvest 2015 is 10.84hl PA per hectare. This increase in production will allow the increased demand to be matched, while also supplying the climatic reserve.

Click to see the full size 2015 Cognac Shipments Results image.