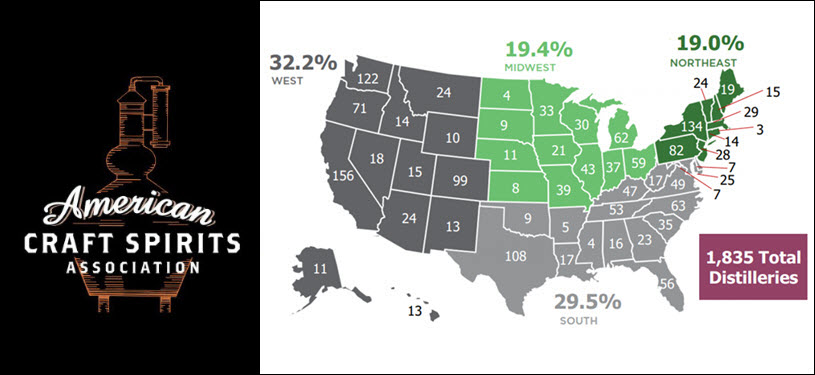

The American Craft Spirits Association was created in 2013 as the industries first national non-profit association representing craft spirits makers throughout the United States. In 2016 the association started to collect data on the growing industry to quantify the number, size, and impact of crafts spirits producers across the country. As you can imagine, with the number of craft distilleries growing from fewer than 100 in 2005 to 1,835 as of August 2018, trying to gather this data is at times like trying to heard cats (in this case distillery cats.)

Number of Craft Spirits Distilleries Continues to Grow at Double Digits

The health of any industry can be gauged by the number of new entrants into the market. If that’s an indicator then this market is very healthy. The number of active craft distilleries in the U.S. grew by 15.5% over the last year to 1,835 distilleries. The Association defines active craft distillers as, “licensed U.S. distilled spirits producers that removed 750,000 proof gallons (or 394,317 9L cases) or less from bond, market themselves as craft, are not openly controlled by a large supplier, and have no proven violation of the ACSA Code of Ethics.” As local, state and federal laws continue to slowly trim many archaic Prohibition era rules and consumers continue their thirst for distilled spirits we expect this number to continue to grow.

How the Association Defines Size

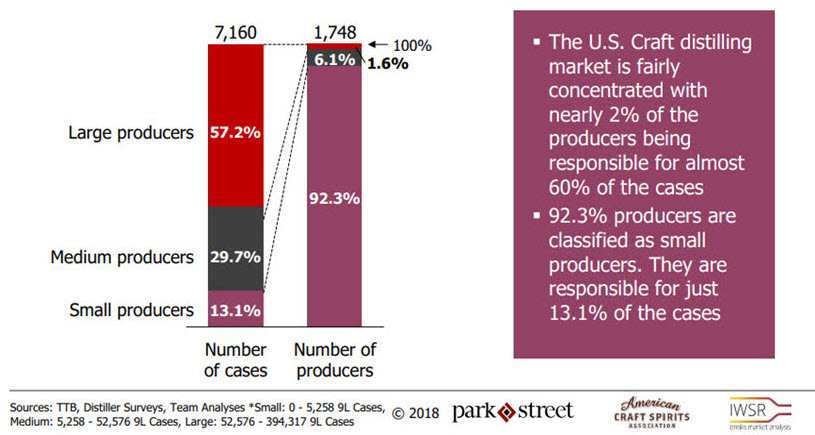

Craft spirits distilleries come in all shapes and sizes from a one person operation making a barrel per week to distillers making up to 750,000 proof gallons annually. That’s quite a range. To help put these numbers in perspective, let’s start out by sharing how the Association defines small, medium and large distillers.

- Small Craft Spirits Producers – Producing between 0 and 10,000 proof gallons removed from bond annually or 0 – 5,258 9 liter cases annually.

- Medium Craft Spirits Producers – Producing between 10,001 and 100,000 proof gallons removed from bond annually or 5,258 – 52,576 9 liter cases annually.

- Large Craft Spirits Producers – Producing between 100,001 and 750,000 proof gallons removed from bond annually or 5,258 – 52,576 9 liter cases annually.

Another noteworthy item here is that of ownership. We’ve all seen the headlines about the big fish acquiring the little fish. The Association defines, “independent ownership as having equal or more than a 75% equity stake and/or operational control of the DSP.”

Craft Spirits Market Volume is Fairly Concentrated

Let’s take a look at the number of craft producers and their annual volume of production. What you’ll see is that the large producers represent 1.6% of the producers and make the majority, 57.2% of the spirits. The medium size producers represent 6.1% of the producers and make 29.7% of the spirits. And finally, the small producers represent 92.3% of the producers and make just 13.1% of the spirits annually. Clearly, there are lots of hard working entrepreneurs out there.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Craft Spirits Sales Value Up 29.9%

There are many reasons why people choose to start a distillery. It could be they are trying to restart a family tradition from the 1800s, it could be they are tired of the corporate grind and want to build something for themselves or it could be they just love spirits and want to make their own spirits from scratch. There are as many different paths to starting a distillery as there are distilleries. One thing that many makers learn quickly is that at the end of the day it’s all about sales. Making the spirits is fun and requires a lot of talent and patience but without sales, the business isn’t going to last.

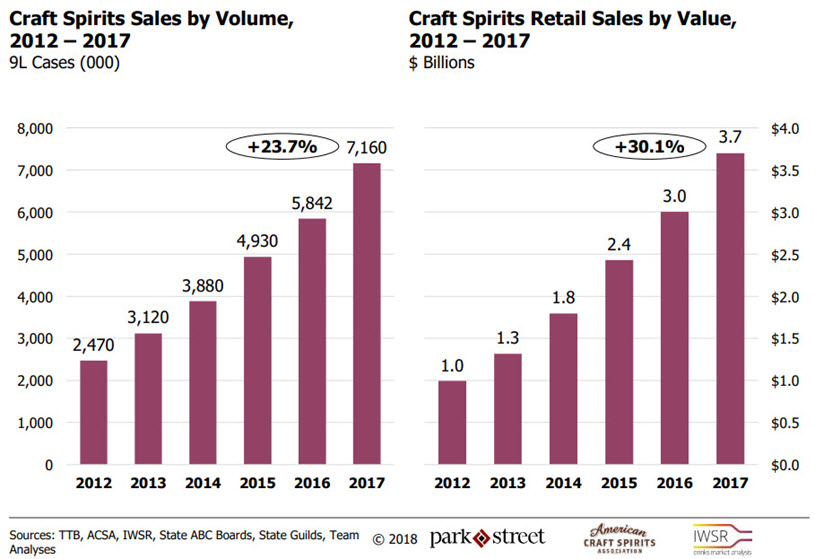

The craft distilling industry sold nearly 7.2 million cases in 2017, up 23.7% in volume over 2016, with $3.7 billion in sales and 29.9% growth by value. The market share of U.S. craft spirits reached 3.2% in volume and 4.6% in value in 2017, up from 1.2% (volume)/1.4% (value) in 2012 and 2.6% (volume)/3.8% (value) in 2016.

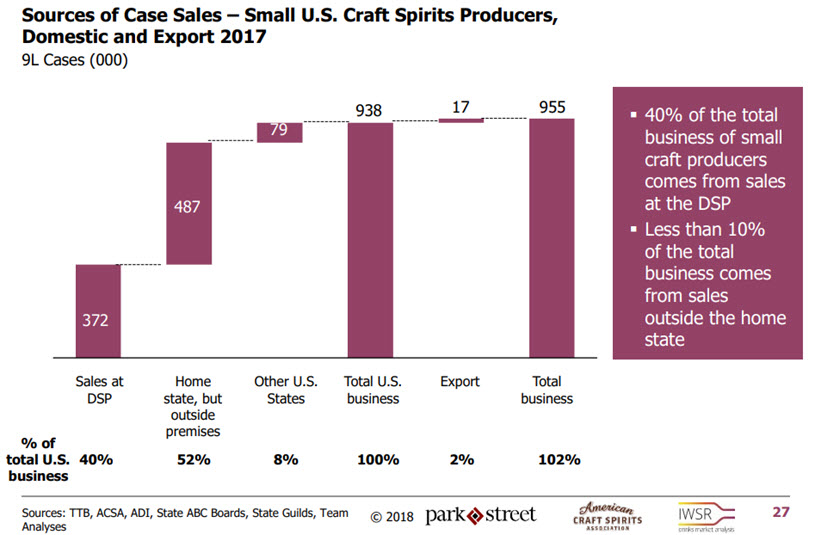

Sales at the Distillery Account for 40% of Total Sales for Small Producers

We all know that driving foot traffic to the distillery and the customer experience at the distillery is important. Looking at the craft industry as a whole, sales at the distillery account for 20.8% of total sales. When you drill down to small craft spirits makers, direct sales at the distillery account for a whopping 40% of total sales while in-state sales for this segment account for 92% of total sales. Laws around on-premise or direct to consumer sales vary widely by state. In some states like North Carolina, consumers could only purchase one bottle per 12 month period up until that law changed to five bottles per 12 month period in June 2017. While other states like Kentucky allow distilleries to sell up to six 750ml bottles per day (technically its 4.5L). Lots of opportunity for growth here for many states.

Investments in the Craft Spirits Industry Has Doubled to $590 Million

Craft Spirits industry investment has doubled over the past two years. In 2017, investment by the U.S. craft spirits industry increased by over $190 million to $590 million in total, doubling from $299 million in 2015. These investments primarily covered the build out of tasting rooms and other visitor experiences, equipment to increase production capacity, and associated labor costs.

There are many contributors to the growth in investments. One of the key drivers that took effect January 1, 2018 was the reduction in the FET – Federal Excise Tax from $13.50 to $2.70 per proof gallon for the first 100,000 proof gallons thanks to Craft Beverage Modernization and Tax Reform Act. This reduction helps to lift all boats in the industry but especially helps the often cash strapped smaller craft spirits makers so they have investment dollars available to expand capacity or hire people to help with sales and production. Keep in mind this reduction is only temporary and expires on December 31, 2019. This is no doubt the number one issue facing craft spirits makers today.

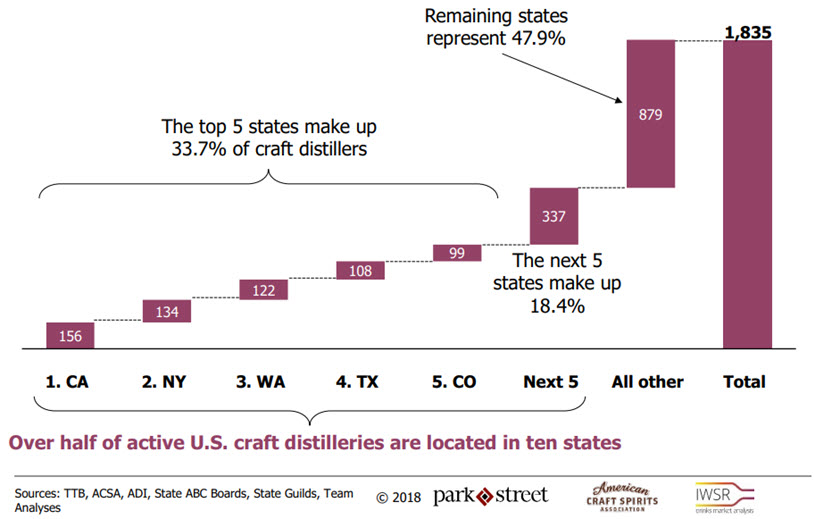

5 States Dominate Craft Spirits with 33.7% of Distilleries

Some states are “craftier” than others, with California (156), New York (134), Washington (122), Texas (108), and Colorado (99) leading the pack. Geographically, the market remains concentrated. These top five states by number of craft distilleries make up 33.7% (619) of the U.S. craft distiller universe, and the next five states – Oregon (71), Pennsylvania (82), North Carolina (63), Michigan (62), Ohio (59) – comprise an additional 18.4% of the market. The remaining states represent 47.9% of the market.

Taking a Look Into the Crystal Ball

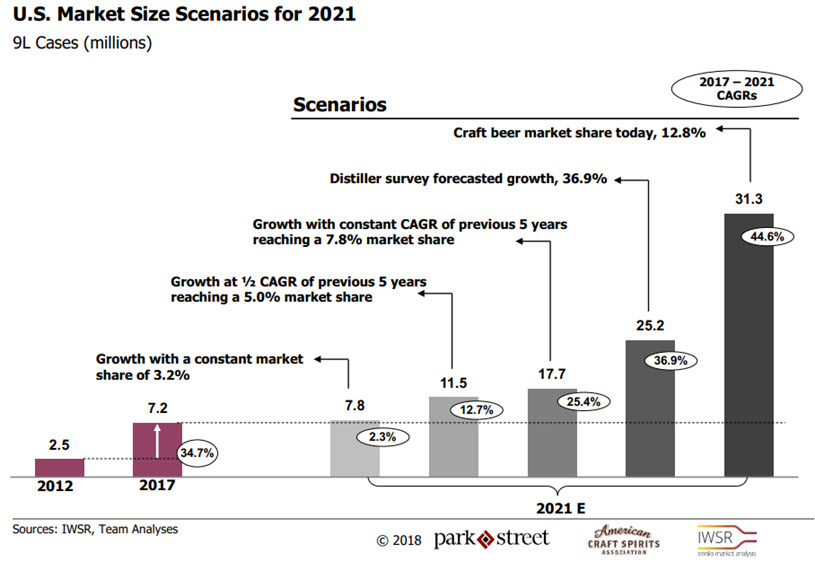

What does the future look like? The future’s so bright, I gotta wear shades. The chart below shows a growth rate of 34.7% over the last five years from 2012 to 2017. The forward looking data from IWSR takes a look at five possible growth scenarios through 2021.

Resource: The full “2018 Craft Spirits Data Project” can be downloaded here.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.