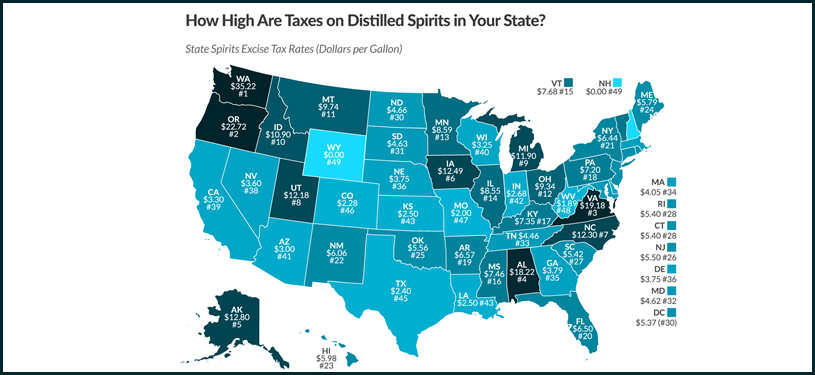

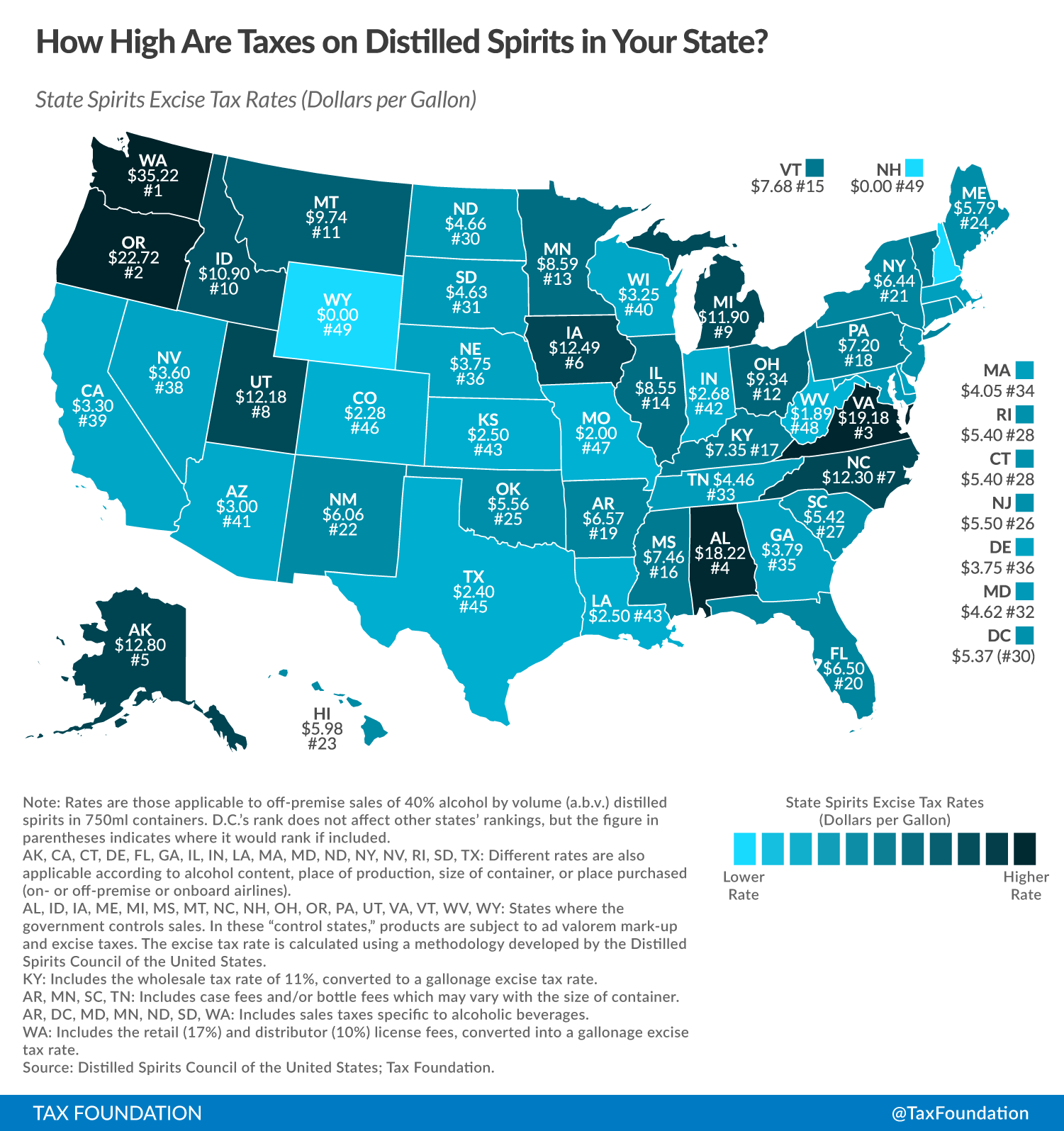

We recently took a look at Federal Excise Tax – FET to compare Distilled Spirits, Wine and Beer. The rates vary widely from $13.50 for Distilled Spirits to $1.07 for Wine and $0.58 for Beer. Today, we are drilling down on the State Excise Tax rate for Distilled Spirits. If you have not seen these rates before, you will find this is really an eye opening experience. The state tax rates vary from a low of zero, nada, zilch up to an incredibly high $35.22.

The state tax data was gathered by the Distilled Spirits Council of the United States – DISCUS and assembled by TaxFoundation.org into a nice state by state map to show you the differences. All the rates are based on Dollars Per Gallon.

Top 5 States with the Highest Distilled Spirits Excise Tax

- Washington, $35.22. *(e) Includes sales taxes specific to alcoholic beverages. (f) Includes the retail (17%) and distributor (10%) license fees, converted into a gallonage excise tax rate.

- Oregon, $22.72. *(b) Control state.

- Virginia, $19.18. *(b) Control state.

- Alabama, $18.22. *(b) Control state.

- Alaska, $12.80. *(a) Different rates are also applicable according to alcohol content, place of production, size of container, or place purchased (on- or off-premise or onboard airlines).

Top 5 States with the Lowest Distilled Spirits Excise Tax

- Colorado, $2.28

- Missouri, $2.00

- West Virginia, $1.89. *(b) Control state.

- New Hampshire, $0.00. *(b) Control state.

- Wyoming $0.00. *(b) Control state.

How to Use the Charts

- You can click on the How High Are Taxes on Distilled Spirits in Your State map to see it full size.

- Further down on the page we dropped the data into a sort-able chart. The default sort sequence displays the highest rate first. You can click on any of the column headers to resort the data in any order you would like.

- And finally, we answer the question, “What’s a Bottle of Jack Cost by State?”

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

How High Are Taxes on Distilled Spirits by State Map

How High Are Taxes on Distilled Spirits by State Sort-able Table

Here’s the list sorted by price from highest to lowest. You can click on State, Tax Rate or No column headings to resort the list.

[table “” not found /](a) Different rates are also applicable according to alcohol content, place of production, size of container, or place purchased (on- or off-premise or onboard airlines). (b) Control states, where the government controls all sales. Products can be subject to ad valorem mark-up as well as excise taxes. (c) Includes the wholesale tax rate of 11%, converted to a gallonage excise tax rate. (d) Includes case fees and/or bottle fees which may vary with size of container. (e) Includes sales taxes specific to alcoholic beverages. (f) Includes the retail (17%) and distributor (10%) license fees, converted into a gallonage excise tax rate. Note: Rates are those applicable to off-premise sales of 40% alcohol by volume (a.b.v.) distilled spirits in 750ml containers. D.C.’s rank does not affect states’ ranks, but the figure in parentheses indicates where it would rank if included. Source: Distilled Spirits Council of the United States

How Does This Impact the Price at the Counter?

The bottom line for consumers is what’s the total out of pocket cost for a bottle? I came across this list from Gizmodo that shows the cost of a 750ml bottle of Jack Daniels in every state. As the author says, this is not exactly a scientific pricing study, it was several phone calls to average liquor stores across the U.S. The data is a couple years old but it shows how the prices vary widely.

On the low side you can pick up a bottle of Jack Daniels in New Mexico for $15.99. New Mexico is number 22 on the excise tax list with an average rate of $6.06. On the high side, Alaska makes the top of this list. A bottle of Jack in Alaska will set you back about $35.00. Alaska ranks #5 on the highest excise tax rate of $12.80. Apparently, everything is bigger in Alaska including liquor prices!

The Price of a Bottle of Jack in Every State Sort-able Table

Here’s the list sorted by price from high to low. You can click on any column heading to resort the list.

[table “” not found /]Related Stories – Sign up for our newsletter to be notified of Parts 3-4.

- Part 1: The Distilled Spirits Federal Excise Tax Rate is 1162% and 2228% Higher Than Wine and Beer

- Part 2: A Look at Distilled Spirits Taxes by State [Infographic]

- Part 3: A Look at Beer Taxes by State [Infographic]

- Part 4: A Look at Wine Taxes by State [Infographic]

Please help to support Distillery Trail. Like us on Facebook and Follow us on Twitter.