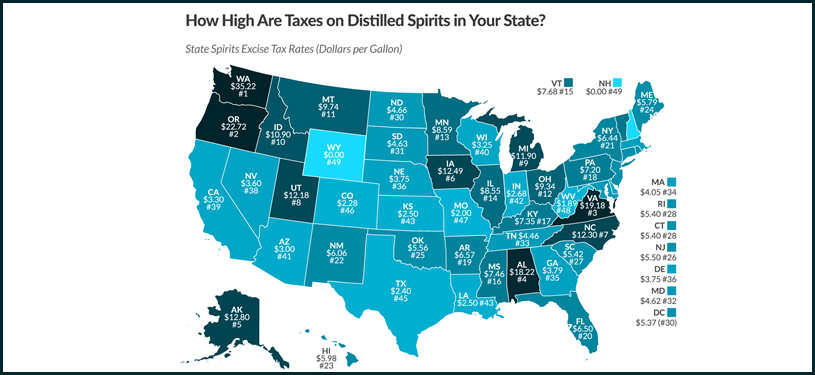

Oregon, the state that’s home to more than 70 craft distilleries in the U.S. has the second highest Federal Excise Tax – FET of any state in the nation. The FET rate varies widely across the country from a low of $0 in states like Wyoming and New Hampshire to a high of $33.54 for Washington and $22.74 for Oregon. Now, the state’s Governor Kate Brown has included a request in her 2017-2019 budget for another $.50 hike. The newly-proposed markup is in addition to the previously approved “temporary” markup of 50 cents, thus adding $1 per bottle to the price paid by spirits consumers.

Distilled Spirits Council Calls Proposed Tax Hike “Punitive”

The Distilled Spirits Council today blasted the massive new spirits tax proposed by Governor Kate Brown, calling the additional markup of 50 cents per bottle a stealth tax that unfairly targets Oregon’s consumers of distilled spirits.

“Oregon spirits consumers already pay more than their fair share in taxes,” said Distilled Spirits Council Regional Vice President Adam Smith. “The spirits sector already generates $245 million in state and local taxes, with 60 percent of a bottle’s shelf price going to taxes. Since Oregon’s excise tax rate is five times the national average, adding yet another tax is simply punitive.”

“Oregon Liquor Control Commission Chairman Rob Patridge and his colleagues have made great strides in modernizing their operations to better serve consumers and spirits makers while generating additional revenue for the state. Targeting distilled spirits sold in Oregon with another major tax increase hurts consumers, as well as the state’s growing distilling community.”

Related Stories

Part 1: The Distilled Spirits Federal Excise Tax Rate is 1162% and 2228% Higher Than Wine and Beer

Part 2: How High Are Distilled Spirits Excise Taxes in Your State [Infographic] (Sort-able list by State.)

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

No Such Thing as Temporary Tax – 100% Increase Proposed

On August 19, 2016, the Commission voted to extend its $0.50 surcharge on distilled spirits through June 30, 2019. Based on the current Oregon Liquor Control Commission – OLCC forecast, this surcharge is expected to generate an additional $36.5 million in revenue during the 2017-19 biennium, which amounts to a net of $32.8 million after adjustments for cost incurred on OLCC. Furthermore, Senate Bill 501 (2015) amended the statutory language related to the distribution of liquor revenue (ORS 471.810) to direct any revenue from Commission imposed per bottle surcharges to the General Fund.

The Governor’s Budget proposes to increase the current surcharge on distilled spirits from $0.50 per bottle to $1.00 per bottle beginning July 1, 2017 and extending through June 30, 2019.

Oregon 2017-2019 Projected Revenue Shortfall

The increase in Brown’s budget is an attempt to raise the states revenue to address a $1.4 billion budget shortfall.

According to the governor’s budget proposal, going into the 2017-19 biennium, Oregon’s general fund and lottery revenues are projected to grow by $1.3 billion. However, the cost to fund the current level of state services is projected to grow by $2.7 billion, leaving a $1.4 billion shortfall. Among the main drivers of this cost growth are:

- Increased state responsibility for healthcare costs, including the state’s share of the cost to fully implement the Affordable Care Act after federal funds for start-up go away, as planned ($1 billion)

- Increased state responsibility for funding public education by $781 million

- The Public Employee Retirement System (PERS) unfunded liability in the aftermath of the Supreme Court’s June 2015 decision striking down key elements of PERS reform ($354 million).

Additionally, after the 2016 General Election, the projected shortfall for the 2017-19 biennium that was previously $1.4 billion grew to more than $1.7 billion.

Economic Impact of Distilled Spirits on Oregon

The distilled spirits sector is a significant part of Oregon’s economy, supporting more than 15,000 local hospitality jobs, paying out $275 million in wages and generating $1.4 billion in economic activity for the state.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.

Resources

State of Oregon 2017-2019 Governor’s Budget

2017-19 Governor’s Recommended Budget

Tax Foundation Facts & Figures 2016