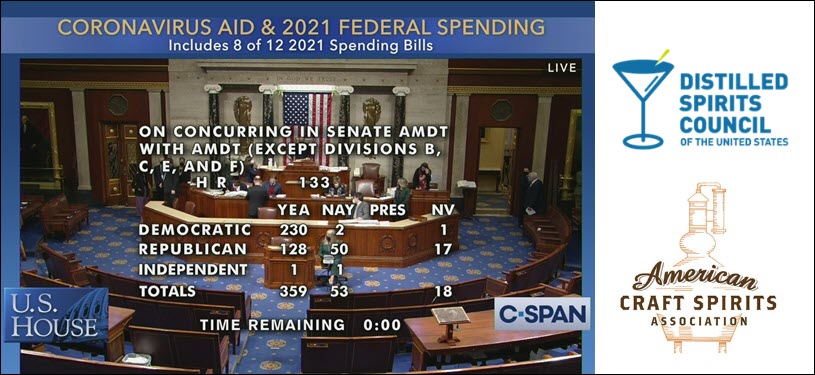

Tonight by a 359 to 53 vote, the House approved the 5,593-page Coronavirus Relief Bill, the longest bill ever created. The bill includes a provision to remove one key word that affects distillers of all sizes across the country. The section that refers to the reduction in the Federal Excise Tax – FET for makers of distilled spirits the words “Temporary Reduced Rate” will have one word removed to read simply, “Reduced Rate”. The change would be effective after December 31, 2020.

The bill will now move on to the Senate is now expected to vote on and pass the Craft Beverage Modernization and Tax Reform Act (CBMTRA) later tonight or early tomorrow. From there the President is expected to sign CBMTRA, making a reduced Federal Excise Tax (FET) permanent for the country’s 2,200 craft spirits producers.

In a statement from the American Craft Spirits Association – ACSA they stated that the FET relief comes as part of an omnibus and stimulus package, giving craft distillers parity with their counterparts in beer and wine, who have enjoyed lower rates for many years. In addition to the hardships the industry faces as it crawls back from distillery closures due to COVID, distillers face a 400 percent tax hike come January 1, 2021 without legislation.

Since 2011, craft spirits producers across the U.S. have rallied together in an effort to push forward long-term FET relief, and it is clear that this grassroots storytelling effort is working. Over the past five years, the ACSA has facilitated thousands of meetings with Members of Congress and their staffers. Even amid a COVID-19 shutdown, ACSA brought 150 craft spirits producers and the entire Board of Directors and Past Presidents to the Hill virtually to share their stories.

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

“We applaud the House for moving forward and passing this critical piece of legislation—a lifeline for our already crippled industry due to COVID-19 closures,” said Margie A.S. Lehrman, CEO the ACSA. “We are cautiously optimistic that permanent FET reform is just hours away. We have promised not to stop until our industry receives permanent, long-term reform, and that remains the case tonight as we eagerly await further news.”

The Distilled Spirits Council of the United States – DISCUS also released a statement following this breaking news.

“Making the federal tax reduction permanent for craft distillers brings optimism and hope to hundreds of small distilleries across the country that are on the verge of collapse as a result of the pandemic,” said DISCUS President & CEO Chris Swonger.

“The distilled spirits industry is grateful to members of the House for recognizing the dire situation facing craft distillers in their districts, and for acting to secure much-needed tax relief for more than 2000 craft distillers nationwide. We urge the Senate to pass this legislation swiftly to accelerate the recovery of these small businesses and their surrounding communities.”

Part 1 of 3: Making the FET Reduction Permanent

This is Part 1 of three parts in this tax reduction journey that’s been happening for nearly 10 years. Part 2 will require passage by the Congress followed by Part 3 and the final step with the signature of the President.

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Instagram and Twitter.