Every year since December 5, 1933 at 5:32pm American’s have celebrated the signing of the 21st Amendment and the Repeal of Prohibition. Similar to the outcry for repeal 86 years ago people today in the beer, wine, cider and spirits sectors are coming together and asking their beloved fans, family members, bartenders, employees, farmers, distributors and retailers to take action. The call to action is to contact their state representatives and ask them to support the Craft Beverage Modernization & Tax Reform Act of 2019 (CBMTRA) and make it permanent.

In 2015, a bill was introduced to lower the Federal Excise Tax – FET for production of distilled spirits. It took two years of hard work by hundreds of distillers and many fly-in trips to Washington, DC but on December 20, 2017 the Craft Beverage Modernization & Tax Reform Act finally passed by a slim 51 to 49 vote margin and a few days later it was signed by the President. It was the first time in nearly 150 years that legislation lowered Federal Excise Tax for wineries, breweries and distilleries. It became law on January 1, 2018 but was only approved for two years and is set to expire on December 31, 2019. We are now in the 24th month and the clock is ticking.

In February 2019 the Senate introduced S.362 and the House followed suit and a week later introduced HB 1175 to make the Craft Beverage Modernization and Tax Reform Act permanent. At the time both bills had just over a dozen supporters in the House and Senate. When we reported on it again in June those numbers increased to 218 and 65 respectively. Today the House is at 323 and the Senate is at 73. You can see the full list below of the members that have supported the bill below. If your representative is not on the list please take action on this year’s Repeal Day on December 5th and tell your representative to co-sponsor the Craft Beverage Modernization & Tax Reform Act of 2019 to make the Federal Excise Tax reduction permanent.

TAKE ACTION: Call Your Legislature on December 5th — Repeal Day!

You can do your part by either writing an old fashioned personal letter, calling, emailing or use this simple form that Spirits United has put together here to make the process as simple as possible.

“If the FET bill isn’t passed, there is going to be a rush to get price increase paperwork through the various state agencies,” said Marc Christensen Founder Dented Brick Distillery. “Generally speaking, most agencies need three or four months lead time on price changes. Utah won’t let me change prices until April, as the February price changes were due end of November. In general consumers are going to have to pay more for Craft. It is really hard for my facility to compete on price with the big six distillers. Their volume allows them to purchase supplies and materials at much lower prices than I am going to get with my 15,000 cases. The FET was a break we needed to get into the market at a reasonable price. I am going to lay off two employees through April if it doesn’t pass. Then I’ll get my price increase and bring the guys back on, assuming they are willing. Keeping fingers crossed.”

Taxes for Our Vodka will Go from $49,700 to $249,900

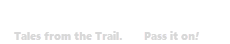

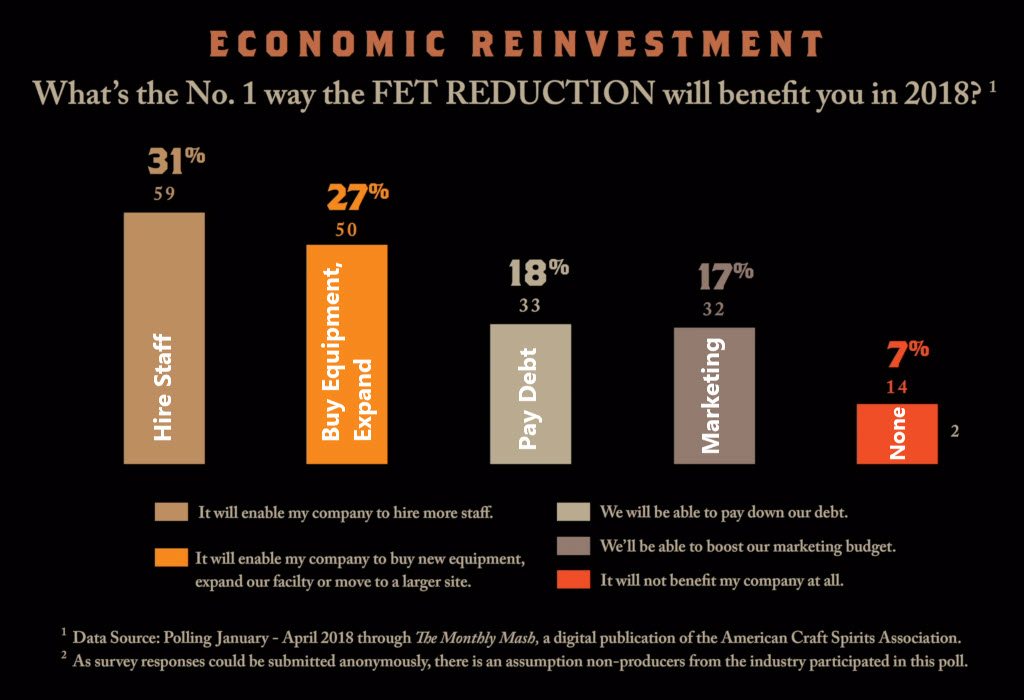

Prior to the Craft Beverage Modernization and Tax Reform Act distillers paid $13.50 per proof gallon regardless of the total number of gallons. The 2017 law created tiers to help reduce the tax rate for craft spirits makers. To be clear all distilleries benefited from the reduction but the vast majority of craft spirits distilleries make well under 100,000 proof gallons per year. The current law breaks the tax rate into the following tiers.

- $2.70 Per Proof Gallon for the first 100,000 Gallons

- $13.34 Per Proof Gallon between 100,000 and 22,130,000 Gallons

- $13.50 Per Proof Gallon More than 22,130,000 Gallons

“For our Well Vodka, we pay $.71 per bottle in Federal Excise Tax now,” explained Christensen.” If the bill does not pass we will pay $3.57 per bottle. This expense will be passed directly to the consumer increasing a $14.99 bottle of vodka to $18.49. For this vodka, we currently sell approximately 70,000 bottles, so the tax goes from $49,700 to $249,900.00! It may be the end of us.”

Stay Informed: Sign up here for the Distillery Trail free email newsletter and be the first to get all the latest news, trends, job listings and events in your inbox.

Ted Huber, Huber’s Starlight Distillery. See all Indiana Distilleries.

Amir Peay, James E. Pepper Distillery. See all Kentucky Distilleries.

Herman Mihalich, Dad’s Hat Pennsylvania Rye Whiskey. View all Pennsylvania Distilleries.

Andy Nelson, Nelson Green Brier Distillery. See all Tennessee Distilleries.

Supporters of Craft Beverage Modernization and Tax Reform Act

Below is the list of cosponsors for these two bills as of today’s date. If you don’t see your state representative on the list please call, email or visit them in person. Better yet, invite them to your distillery and show them the impact the tax reduction has had on your business.

You can sort the list below by clicking on the Cosponsor Name, Party or State to easily find your representative.

116th House of Representatives Cosponsors – H.R. 1175 / PDF of Bill

[table “” not found /]

* = Original cosponsor

116th Senate S.362 / PDF of Bill

[table “” not found /]

* = Original cosponsor

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.