Craft spirits makers are feverishly working with their state Congressional representatives at home and in Washington, D.C. to try to make the Craft Beverage Modernization & Tax Reform Act (CBMTRA) permanent before the looming deadline this Friday December 20, 2019 (the date Congress is due to recess for the year). Not renewing this act will have real consequences for thousands of distillers and their communities across the United States.

Looking for Active Engagement – Calls are Making a Difference

More than anything what will help the nearly 2,000 craft spirits distilleries across the United States right now is active engagement. Even though co-sponsorship of Senate Bill S.362 and House Bill HR 1175 have reached a majority in the House and Senate it is still important to let your leaders know that this is a grass roots issue that affects many small businesses.

“The CBMTRA (HR 1175 and S 362) is one of the most highly supported, bipartisan bills in recent modern history (a comment we’ve heard repeatedly around the capitol),” said Mark Shilling Founder Shilling Crafted and Past President of the American Craft Spirits Association. “With roughly 75% of the House signed on, it more than meets the 2/3rds rule for going straight to a floor vote, so it is possible it could move on its own. That is something we’ve talked with the House leadership about and though it’s technically possible, I believe it is highly unlikely.”

“The anxiety level with these small distilleries is high,” said Chris Swonger Chief Executive of the Distilled Spirits Council of the United States – DISCUS. “Industry representatives expect that many small companies will have to lay off employees or close entirely, a turn that could undermine the country’s boom in craft brewing and distilling. Particularly frustrating for these companies is the fact that the tax cut enjoys overwhelming bipartisan support — a House bill to make it permanent, introduced earlier this year, has 324 co-sponsors, while an identical Senate version has 73.”

“Such legislation would normally sail through Congress, most likely as part of a so-called extender package of similar targeted cuts. Instead, observers say, it has become a casualty of congressional dysfunction and partisan fighting over taxes and spending.”

You can look at the list nearer the bottom of this story to see which Congressman and Senators have supported the bill. If your representative is not on the list call them and ask for their support. If your representative is on the list then call them and ask them to reach out to their respective leadership and tell them how important it is to get this done. And, if your representative is in one of the districts on the list immediately below you should call directly today. These people are key to passing this legislation.

House

[table “” not found /]

Senate

[table “” not found /]

Related Story

Distillers Just Weeks Away from a 400% Federal Tax Increase Unless You Take Action on Repeal Day 2019

What is at Risk Here? Job Cuts and Up to 5% Closures

We don’t like to be Debbie Downer but not making this FET reduction permanent will have significant negative affect across many communities. Since the lower rates took effect on January 1, 2017 nearly 200 new craft spirits distilleries have opened. These young startups business will have a hard time paying these new fees that come due every two weeks.

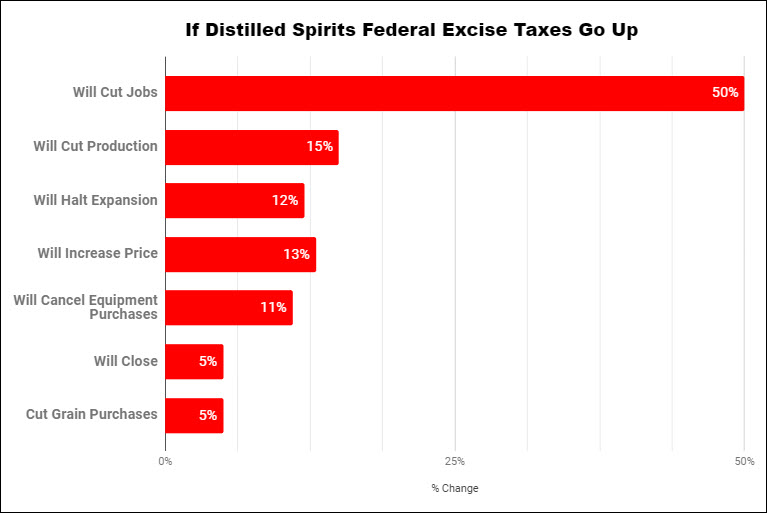

The American Craft Spirits Association recently surveyed their members and here is what they found. Keep in mind the association members businesses come in all different shapes and sizes.

- 50% will take action to immediately cut jobs

- 15% will cut production

- 12% will halt any expansion

- 13% will increase pricing (Side note: I think it will be very difficult for small distillers to raise prices without getting substantial pushback from wholesalers and retailers.)

- 11% will either cancel or stop negotiating equipment purchases

- 5% will close shop

- 5% cutting grain purchases to local farmers

What are the Chances of Passage of CBMTRA in 2019?

“We’re in the red zone, its fourth down and the clock is ticking, but I’m convinced we can pull it off,” says Shilling.

“At the moment I am feeling pretty 50/50 but with wild swings from cautious optimism to resigned pessimism at back. One thing is clear though, the calls from distillers, vendors and suppliers, and consumers is definitely having an impact, and many of the offices we are taking to are giving credit to the people pushing CBMTRA for keeping all of the extenders discussion in play.”

Is it Dead if it Doesn’t Pass This Week?

If this happens to get bundled into something else and passes by week’s end that’s great but if it doesn’t there’s still hope that something will happen. Something could get passed that would extend the tax reduction (perhaps for one year or less) or it could become permanent and people running these small businesses can get back to building their business.

“There has been some talk of passing it sometime next year and making it retroactive to January 1, 2020,” said Shilling. “It really could come up any time. There are several problems with this, chiefly that most distillers will have to start paying the higher tax in January. As the rate goes up, more and more will be forced into bimonthly payments from quarterly, so by the time something might pass later next year, the damage will have already been done. Another factor is TTB. Not only are they already understaffed, there is no process in place for tracking, figuring and making refunds and once passed by Congress it could easily be months before TTB is able to process them.”

“Another – probably minor, for most – issue is the bond requirement. As the rate increases, distilleries that don’t currently have operations & removal bonds will be required to get them. Although ‘relatively’ inexpensive, if a distillery does not have one in place, they will be required to pre-pay their excise tax. So, if you wake up on Dec 21st and we have no excise tax deal and you don’t have a bond, you should probably put it on your Christmas list.”

Craft Spirits Makers are Part of the ‘Local Community’

If you have been following this issue you know it’s a big deal for distillers. It is also a big deal for local communities. If you go back 15 or 20 years craft spirits distilleries really didn’t exist. Today there are nearly 2,000 craft spirits distilleries in communities all over the country. These local businesses are bringing jobs, new investments, new residents and reviving life to often run down neighborhoods.

To emphasis the local aspect of these small business we had a discussion earlier today with Ted Huber Owner & Master Distiller at Huber’s Starlight Distillery and Chairman of the DISCUS Craft Advisory Council. Ted and his family operate a farm, orchard, restaurant, winery and distillery in rural Starlight, Indiana. It also happens to be the No. 1 tourist destination in the state.

“The average consumer doesn’t know the difference between beer, wine and spirits and taxes and all the infrastructure that a distillery has that a brewery doesn’t,” said Huber. “Once they start meeting people like me and other distillers families people care. We are trying to make a business, hire employees and be a part of a local community. We are a face in the community and we are doing community events, opening up and revitalizing areas that were falling apart in towns and cities.”

“That’s why this FET reduction is so important. We can keep that money here. That money can stay in our local community and doesn’t flow up to the federal government. It stays in our local community and people care about that they know about money sticks. Once it leaves a community, it doesn’t come back.”

“That FET money stays in the local community where the distillery is at. It allows us to sponsor the local little league, local schools, cocktails at local concerts and things like that.”

“When people are looking for donations or sponsors for their little league team, local schools, cocktails at local concerts and things like that they don’t have anyone to talk to at the big box store but if they knock on our door they know us because we are a part of the community. That’s why making this FET reduction permanent is so important.”

Supporters of Craft Beverage Modernization and Tax Reform Act

Below is the list of cosponsors for these two bills as of today’s date. If you don’t see your state representative on the list please call, email or visit them in person. Better yet, invite them to your distillery and show them the impact the tax reduction has had on your business.

You can sort the list below by clicking on the Cosponsor Name, Party or State to easily find your representative.

116th House of Representatives Cosponsors – H.R. 1175 / PDF of Bill

[table “” not found /]

* = Original cosponsor

116th Senate S.362 / PDF of Bill

[table “” not found /]

* = Original cosponsor

Please help to support Distillery Trail. Sign up for our Newsletter, like us on Facebook and follow us on Twitter.